What Is Bank Scheduling Software? Top Appointment Booking FAQs for Banks and Credit Unions

Your customers and members know what they want: fast, convenient, and easy self-service tools they can access from anywhere. They don’t want to waste time in long lines, wait on hold to connect to the right person, or fill out a form and wait days for a response to an appointment request.

This is where bank scheduling software comes in. By letting clients choose their own path, appointment booking software ensures every interaction with your institution is a great one.

In this article, we’ll explain everything your financial institution should know about bank appointment software: what it is, how it works, and why it’s so essential to improving your customer or member experience, operational efficiency, and revenue growth.

What Is Electronic Appointment Scheduling?

Electronic appointment scheduling is an easy-to-use, flexible system that allows people to book their own appointments with advisors at your financial institution. Customers, members, and staff can access the software from any computer or mobile device, and then choose when, where, and how to meet by viewing open time slots in a calendar.

Clients can use the system any time of day—even outside of business hours—and adjust appointments in just a few clicks. The system makes it easier to match customers and members with the right specialist and gives staff greater visibility into scheduled appointments across the entire financial institution.

Appointment booking software offers more than self-serve bank scheduling for in-person and virtual meetings. It also delivers queue management tools, video banking, analytics, and data. Ultimately, the all-in-one platform creates a simple, intuitive experience before, during, and after appointments.

More great news: Bank scheduling software benefits both customers/members and staff in a host of ways:

- More convenience. It gives customers and members greater control and choice in the appointment setting and queuing process, which improves the user experience and overall satisfaction levels.

- More efficiency. It gives employees an easier way to communicate and schedule appointments, automates reminders, records notes and outcomes, and more—all of which saves them time and reduces the administrative burden on staff.

- More insights. It benefits financial institutions as a whole by offering greater visibility and data insights—like appointment volume, foot traffic, and staff capacity. This helps banks and credit unions make smarter decisions around branch strategy, services offered, staffing, and more.

How Does an Appointment System Work?

Bank appointment software is intuitive and easy to use. Let’s dive into the nuts and bolts of how it all works.

Seamless Integration With Staff Calendars

Appointment systems seamlessly connect with your team’s existing calendars (Google, Microsoft, etc) to find their appointment availability. These real-time integrations show live availability to customers, members, and staff alike so there are no double- or over-bookings.

Backend users can set team availability by hours, specific times for certain appointment types, or even set up by location availability by branch. It can also be configured for hybrid or virtual appointment options and hours for staff who want to handle appointments remotely. (This depends on if video banking options are integrated into the system or not.)

Staff can also share individual links to their calendars so customers and members can book with them directly.

Advisors can view their meeting schedule at a glance, and learn more about customers or members before their appointment. And once the appointment is over, they can record outcomes and take notes on follow-ups, making every interaction more effective.

Proactive, Easy Booking

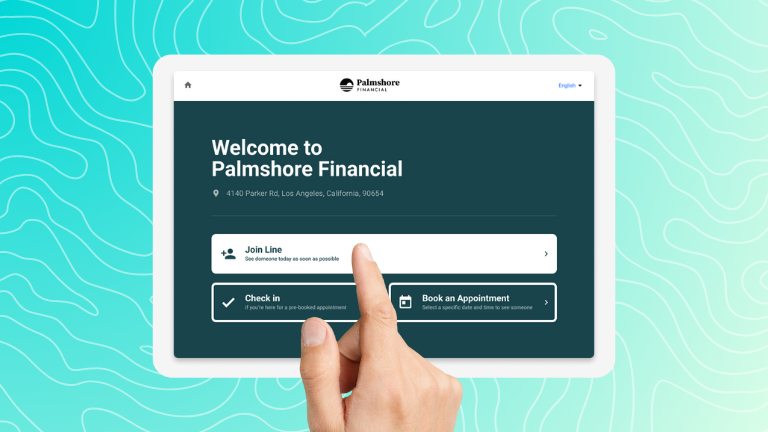

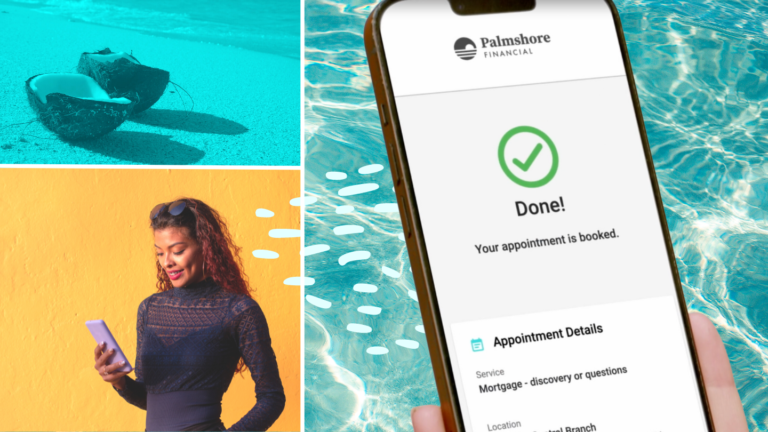

The booking interface that clients and staff see can be embedded or integrated into your website, mobile banking app, and lobby tablet so customers and members have access in-person, at home, or on the go. Customers and members enjoy simple self-service tools that allow them to book an appointment in just a few clicks. No need for them to fumble through your website or wait on hold.

While booking an appointment, they can fill out a quick questionnaire to route them to the right staff member, choose a convenient appointment time and location (or virtual appointment), and provide relevant information for the meeting. They can even check out in-person wait times and join a virtual queue if the appointment scheduling software has queue management integrations or features—all without ever having to wait for the help of a staff member.

And if they don’t want to wait in line? Then they can book an appointment for a later date, either in person, over the phone, or via video. No matter which option they choose, flexibility and convenience are the name of the game.

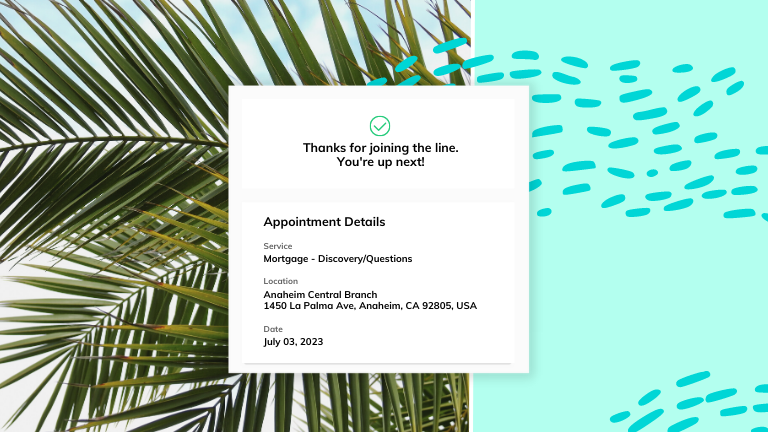

After booking, the customer or member gets a calendar invite with meeting details, along with a link to adjust their appointment if needed. Thanks to easy edit features and appointment reminders, people are less likely to forget about or ditch their appointments.

Simple, Powerful Administrative Controls

On the backend, staff members can use appointment scheduling software to easily make changes to services, add new locations or staff to the system, and track important data related to the appointment.

Metrics like appointment volume, length, and more, help financial institutions see what’s working—and what can be improved to make appointments more efficient and effective. They can also get a bird’s-eye view of staffing capacity, utilization, and branch traffic so they can better understand where they may need more or less staff to serve clients effectively.

Integrations with Customer Relationship Management software (CRMs) or Business Intelligence (BI) tools allow for customer or member appointment activity to be shared across systems for a more complete picture of their engagement with your institution at large.

What Are the Types Of Appointment Systems?

The best bank scheduling software offers many ways for customers, members, and staff to engage and communicate.

Here are just a few of the most common types of appointment systems:

- Manual appointment systems: With manual appointment systems, advisors or other staff members can independently make calendars or private calendars to invite customers or members to an appointment. They can block out time and get greater visibility over their daily schedule. Manual appointment systems empower staff members to be more productive and efficient with their time, but they don’t offer the best accessibility or availability at scale to clients, fellow staff members, and branch or retail operations managers around appointment volume, no-show rates, etc.

- Internal appointment systems: An internal system offers staff members a shared calendar for appointment scheduling. Advisors can view and book appointments on behalf of their clients, and view appointments of other staff members across branches. Calendar blocking standardizes the appointment booking process and gives the entire financial institution greater visibility over appointments and the success of those appointments. However, since clients cannot access these systems, they are not as convenient as self-serve scheduling options. They can also be limited in terms of the depth of analytics and reporting they offer operations or retail management teams.

- Self-service appointment systems: Two-way facing appointment scheduling gives customers and members (in addition to institution staff) the ability to book and manage their own appointments from any internet-connected device. They can book an appointment based on branch location, times, service type, or staff member, and they’ll receive helpful appointment reminders leading up to their appointment. With these systems, advisors can learn about the customer before the appointment, take notes during the appointment, and easily follow up and track data after the appointment. They also offer a more robust view of both client and staff activity to branch and retail management teams.

- Virtual appointment systems: Virtual appointment systems give customers and members the same level of service they receive in person—without ever having to leave the comfort of home. With this type of system, customers can book and manage their appointments, then meet with advisors via secure, easy-to-use video conferencing tools. Advisors can complete transactions just as they would at an in-branch appointment, and people enjoy the time-savings and convenience of virtual service.

Why Is an Appointment System Important?

Bank appointment scheduling is important for several reasons. It helps improve your customer or member experience, increases operational efficiency, provides data-backed insights, and drives growth and retention.

Let’s explore each of these benefits in closer detail.

1. Improve Your Customer and Member Experience

Today’s consumers want more choice, flexibility, ease of use, and visibility from their financial institutions. The pandemic led to a huge shift in consumer habits, with 50% of FI customers’ activities switched from in-person to digital in 2020. Those patterns are sticking in the post-pandemic world, with 36% of customers wanting to avoid branches altogether—up sharply from 26% in early 2020.

Bank appointment scheduling helps meet these details, giving customers and members more control over their experience and streamlining the entire customer journey. This drives higher Net Promoter Scores and better Customer Satisfaction Scores, equating to happier, more loyal customers and members.

2. Increase Operational Efficiency

Bank by-appointment platforms save your staff time by making it easier than ever to book and prepare for meetings. When advisors have more time to plan ahead, they can better serve customers and members, matching them with the products and services they need. When schedules get busy, staff members can reallocate advisors to better handle the influx. Remote video conferencing also minimizes the time advisors spend traveling between branches, which helps reduce appointment lengths, wait times, and administrative burdens.

3. Get Data-backed Insights

Bank scheduling software allows you to collect better data—and make better decisions. Credit unions and banks can bring untrackable events online for analysis, including walk-in traffic, no-show rates, and more. Institutions can use this data to forecast branch capacity, improve wait times, and drive staff performance. Finally, you get the insights you need to optimize performance and keep everyone headed in the right direction.

4. Drive Growth and Retention

Booking an appointment is fast and easy with bank appointment software—meaning your customers and members will do it more often. It only takes a few seconds for them to choose the precise time, location, and platform that works for their schedule, and they’ll be so delighted by the experience, they’ll be more likely to stick around for the long term. Bank appointment scheduling software also helps advisors better prepare for meetings, so they can upsell and cross-sell with ease.

What Software Is Used To Schedule Appointments?

In today’s digital world, organizations can offer many ways for customers to schedule appointments with a myriad of providers. But choosing the right software for your institution comes down to how committed you are to improving the appointment experience and enhancing your understanding of customer, member, and/or staff engagements.

Some organizations just use individual calendar software to book with advisory staff. While these systems alleviate some of the burdens of manual appointment scheduling, they don’t optimize the entire appointment-setting process.

Some may adopt generic self-serve appointment scheduling tools that can be used by multiple industries to book client appointments. However, these systems may not be able to be customized to an institution’s needs and specifications, and they often don’t meet the security standards banks and credit unions require.

The best software is dedicated bank scheduling software. An app designed specifically for the financial services industry will be better suited for the needs of your institution for many reasons:

- It’s made around the needs of your advisory and frontline staff and is built to handle setting up appointments across branches and virtual channels.

- It can more easily integrate with your existing software, systems, tools, and processes.

- It’s often created with more robust security standards to handle personal or financial information.

- Reporting, analytics, and dashboards are created with your team’s needs in mind.

- Future enhancements and product direction will be focused on your industry alone—not the needs of many different users or business types.

What Is The Best Booking App for Appointments?

The best bank appointment booking app depends on the needs of your financial institution. There are many options on the market today, so narrowing down your selection comes down to the top features you need and what you seek in a vendor partnership.

1. Top Features of Bank Appointment Scheduling Software

As you compare features across different bank scheduling software, it’s important to consider the problems your institution is facing: Do customers and members voice frustration about wait times? Are you missing out on opportunities to increase wallet share? Most importantly, how will the software resolve those problems? Is the app designed for an institution like yours?

Here are some of the top features to look for when comparing appointment scheduling software for banks and credit unions. Note: the best systems combine tools across queueing, video banking and analytics for a more holistic solution or platform that delivers greater value to clients and staff alike.

- A simple easy-to-use user experience design in the front end and back end

- Flexible appointment scheduling workflows and interface

- Reliable, real-time calendar integrations

- Customization routing, intake, and self-serve settings to direct clients effectively

- Self-serve rescheduling options

- Digital sign-in and advisor notifications

- Ability to join in-person or virtual queue

- View of wait times across branch locations

- In-lobby appointment scheduling kiosk capabilities, including next-in-line notifications

- Data, analytics, and administrative features, including conversion tracking, branch traffic insights, and staff capacity, utilization and performance tracking.

- Customizable reporting templates and analytics

- Open API for integrations and data sharing, in addition to out-of-the-box integrations

- Single Sign-On for staff and customers and members

- Calls or appointments notes, recordings or transcripts

- Secure video and audio appointment options

- Document co-browsing and signature collection

See a full list of features in our Appointment Scheduling Software Buying Guide.

2. Questions to Ask Software Providers

When considering appointment scheduling and queue software, you want to find a provider that offers more than just a software solution. You want a true partner invested in the success of your institution.

Here are some questions you could ask vendors as you shop around:

- Does the vendor serve other banks and credit unions? Or other industries? Where is their focus?

- Can you sandbox the solution and test the staff and admin experience?

- Does the vendor have a dedicated implementation team, customer success manager, and technical support team?

- Is onboarding support included in the cost of the contract?

- What are the average support response times?

- Do they offer fair and flexible pricing options?

- Do they offer success planning or strategic support?

- Do they offer professional services to help make changes or set up

- Is the vendor SOC II compliant? How does encryption work, and are servers secure?

- What integrations does the software offer? What other industry partnerships do they have, and what is the depth of those partnerships?

How Much Does Bank Scheduling Software Cost?

The cost of bank scheduling software depends on several factors, including the scope of the software, the pricing model, the number of users, and more. Generally, financial institutions can expect to pay a minimum of several thousand dollars a year for secure, high-quality bank scheduling software at minimum.

The best appointment booking software providers offer flexible, fair pricing, making it easy for banks and credit unions to find a plan that supports their needs and budget. Packages are built to grow with the business and give the institution the tools and best practices needed to delight clients, drive productivity, and increase revenue.

Pricing models come in all shapes and sizes, including subscription models, plans based on the number of users, and plans based on the number of branches or appointments hosted.

Banks and credit unions can also customize their plan with add-on services, such as pre-built integrations, video banking, branch locator tools, and other professional services to help them get up and running quickly.

Is Appointment Scheduling Software Secure?

In a world where only 51% of consumers trust their primary financial institution with their data, it’s more important than ever to be a bank or credit union your customers and members can trust.

The best bank scheduling software vendors understand the unique SaaS privacy and security needs of banks and credit unions. Not only do they meet these requirements—they surpass them with industry-leading standards and strict security policies.

Here’s what you can expect from a secure appointment scheduling software provider:

- Data encryption: All data is encrypted in transit and at rest, using industry-standard practices.

- Secure data hosting: Data centers are SOC 1, SOC 2, and SOC 3 certified, and offer exceptional data, network, and operational security.

- Data monitoring: The latest tools and methods are used for intrusion detection, configuration monitoring, vulnerability monitoring, and file integrity monitoring.

- Frequent backups: Incremental backups run hourly throughout the day, and full nightly backups ensure data is always there when you need it.

- Thorough incident response procedures: Detailed incident response plans protect data in case of an emergency.

- Employee background checks: All employees pass a standard criminal record check and must sign non-disclosure agreements (NDAs) before receiving any sensitive or proprietary information.

How Do You Implement Bank Scheduling Software?

With the right bank scheduling software, implementation is quick and straightforward. The process can take a few weeks to a few months, depending on the level of internal IT support and integration needs of the institution.

To set yourself up for success, be sure to gather data early in the process, map out exactly what you want your appointment software to do, and take ownership from the very beginning. The hardest part of the process will be getting people to change old habits—but with consistent marketing, incentives, and training, you’ll be on your way to incredible results.

Here are eight steps to a successful bank appointment software rollout:

- Project kickoff: Meet the launch team and begin the implementation process.

- Design, configure, and test: Design workflows tailored to the unique needs of your bank or credit union.

- Train and excite: Train staff members and get them excited about the time-savings, data insights, and customer satisfaction they’re about to gain.

- Launch and market: Start using and promoting the system to customers and members.

- Success planning: Create SMART metrics to support your goals, then build a plan to help you achieve those goals.

- 1-on-1 coaching: Meet regularly with a Customer Success Manager to get the most out of your bank scheduling software.

- Executive business review: Meet with your executive sponsor and team to reflect on your progress and areas for development.

- Achievement: Achieve your goals, update your success plan, and continue driving revenue and growth.

Get a full roll-out kit for appointment software with our comprehensive Launch Guide.

What’s The Expected ROI of Bank Appointment Software?

If you’re investing in software, you certainly want to get your money’s worth. Fortunately, bank appointment software offers a tangible return on investment.

Here are four areas where you’ll see measurable ROI at your bank or credit union:

- New revenue: Self-serve appointment and queuing software gives financial institutions the chance to get in front of new and existing customers and members who want high-value services. In fact, most banks and credit unions see an average increase of 13% in booked appointments and 150% more revenue after implementing appointment scheduling software.

- Increased staff efficiency: If you’ve dealt with staffing shortages and unpredictable in-branch traffic over the past few years, bank appointment software can help. On average, banks and credit unions see a 75% reduction in appointment duration and a 33% reduction in the number of appointments needed to close a transaction, thanks to more efficient, productive meetings.

- Recovered revenue: Long lines, call center hold times, and incorrect transfers can all lead to lost conversations—and lost revenue. But easy self-service appointment software changes all that, often resulting in a 23% reduction in no-shows and a 100% reduction in missed call transfers.

- Increase retention: Long lines, lack of choice, and unknown wait times may turn your customers away from you, and over to your competitors. But luckily, appointment software can help recapture customers: most users see a 21-point increase in their NPS score after implementing appointment scheduling software.

How Do I Get Buy-in for Scheduling Software?

Getting buy-in for bank scheduling software is simple—as long as you tell the right story. With the story, the business case for appointment software is clear, and you can win over even the biggest skeptics.

Let’s walk through the key elements of building an unforgettable pitch for bank appointment software:

- What you’re missing out on: Gather real stories to help highlight the frustrations and emotions of your customers and members. Why is it so important for you to deliver an easier, smoother customer experience?

- How you can benefit: Illustrate how customer experience issues connect to your institution’s core objectives. Explain how satisfied, happy customers lead to operation efficiency, growth, and retention.

- How software will solve your problem: Show how bank scheduling software can improve client experiences by routing people faster, reducing wait times, and giving people more choices. Present statistics that show how the right software can help your financial institution grow.

Remember that the best business case is about your narrative. Stay focused on your compelling story, excite your audience, and keep people engaged. Connect your story to your institution’s core objectives, and you have a winning presentation.

Discover The Benefits of Bank Scheduling Software

Bank scheduling software lets your customers and members quickly and effortlessly connect with your bank or credit union. It improves the client experience, saves your staff time on administrative tasks, and increases opportunities for growth and retention.

Put your customers and members at the helm of their banking or credit union experience. Schedule a Coconut Software demo today and discover how bank scheduling software benefits your financial institution—and make connecting with clients a breeze.