Remote Video Banking: Future Proof Branch Strategies

Photo Credit: https://writix.co.uk/

Deploying a digital-first banking platform is not only now possible, but mandatory for financial institutions of all sizes — but this doesn’t mean getting rid of physical locations altogether. 77% of customers still prefer visiting the branch when they want to discuss complex financial topics, and even for digital banking customers, speaking with a live representative still evokes the greatest amount of positive sentiment. Finding that perfect balance between digital and human services is the key to establishing a future proof branch.

As a follow up to Part 3 in our series, today we will be examining the 4th of 5 different strategies that banks and credit unions can implement in order to set their branches up for success in this rapidly changing landscape.

Introduce Remote Video Banking

Video banking has been popular for years now, with many banks having installed ITMs — interactive teller machines — for their drive-up and in-branch kiosks. A number of financial institutions have been successful with this technology, but technology has evolved, and consumer habits with it. Today, millions of people are making video calls through FaceTime and Skype every day, video conferencing in the office is commonplace, and telecommuting is on the rise. With remote video calling becoming so mainstream, customers are beginning to question the need for a branch visit in order to engage with a banking assistant. The expectation that their financial institution extend the same capabilities that they enjoy everyday in communicating with their friends and colleagues to things like mortgage applications and investment consultations is on the rise.

“We recognize that [SMB customers] work unconventional hours, are travelling or might not be able to visit a branch for a number of other reasons. Being able to access RBC Small Business specialists via video wherever and whenever they want helps them maintain that personal connection they expect with our bank.”

Cathy Honor

SVP Contact Centres, Royal Bank of Canada

Currently, most remote video offerings like those of RBC are created for specific use cases — with RBC it’s SMB clients, while others like Barclay’s provide limited retail banking services. In these early stages, these constraints to service levels work to streamline implementation as specialized representatives are able to serve customers from central video contact centers. However, if remote video banking is to be extended to more services in the future, it should also be extended to include the branch itself.

Along with allowing branches to leverage the talented and experienced staff they already employ, it would allow customers the option to engage in a video engagement with a local representative that they know and trust. This not only plays to the strengths of the branch in providing expert face-to-face financial advice, but also fits with what customers are expecting from digital services. According to research from Kony Inc, although 57% of customers want all products, services and support to be available digitally, they want those digital offerings to be supported by a named company representative. Customers want digital, but they also want the trust, security and relationship that comes from physical services. This means combining physical and digital services rather than separating them into two divergent channels — the branch and the video contact center should be working to support each other.

Are Customers Ready?

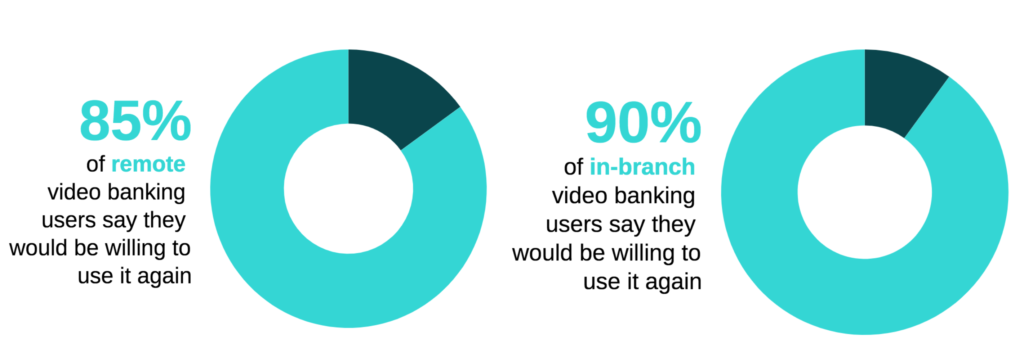

According to a recent study, the future of video banking looks bright, with the vast majority of consumers who try it rating the experience highly. Somewhat surprisingly, consumers who have used in-branch video banking rate their satisfaction with the service slightly higher than those using video services remotely. A difference that could be the result of remote video banking customers having to navigate the system on their own.

The study also found that it is inaccurate to assume that younger, more upscale customers are the most likely to accept video banking. In their research, it was found that all consumers, regardless of age, gender or socioeconomic status, are generally open to trying video banking if/when their bank or credit union asks them.

The fact is that as branches continue to shrink, customers are still going to want to get face time with skilled advisors. The numbers show that 50% of US financial customers are willing to try online banking if their bank offers it, and as illustrated previously, they are generally quite accepting of the technology once they’ve experienced it for themselves. With this in mind, a branch looking toward the future would do well to begin bringing video banking capabilities into their locations today. Doing so will not only enable them to differentiate themselves from the competition today, but to provide both themselves and their customers with a head start on the larger remote video banking transition that is almost sure to happen in the future.

Check out the other articles in the Future Proof Branch Strategies Series:

PART ONE – Self Service Kiosks

Examining the benefits and capabilities that self service kiosks can bring to your branch by eliminating many of the pain points that customers associate with their visit.

PART TWO – Café Style Branches

We discuss design changes in the lobby that can help to encourage relationship building and conversations between advisors and their customers.

Exploring the changes that are being introduced through new Smart ATMs and where that may take us — and the frontline staff that many fear they replace — in the years ahead.

What Next?

Looking for more strategies to meet your customers’ changing expectations around the in-branch experience? Download the full report Becoming Future Proof: Five Proven Strategies for the Branches of the Future to learn more methods in technology, design, and service that branches can take advantage of to adapt in the rapidly changing financial landscape.

Interested to hear what top experts in financial customer experience have to say about the coming challenges branches are looking forward to? Watch our panel discussion Embracing a Customer-First Mindset: Eliminate Friction Points in Your Customer Multi-Channel Journey.

Ready to start taking steps to ensure your branch is set up to meet your customer’s evolving expectations head on? Schedule a consultation with Coconut Software to learn more about how our tailored solutions can help.