5 Appointment Technology Implementation Tips From Institutions Who’ve Done It Right

What does a successful appointment technology implementation actually look like? We tell five stories of smooth-sailing rollouts—including how an internal pre-launch equipped the team at KEMBA FCU for their public launch and how interactive video training led to overwhelmingly positive software adoption at Rogue Credit Union.

Use the collective wisdom of these banks and credit unions to help you navigate your own appointment and queuing software rollout.

Want to dive deeper? Read our 8-step software roll-out guide1. Create Time for Incubation

Candy Shearer, a Senior Member Care Manager at KEMBA FCU, swears by an internal incubation period for your technology implementation process. “On a scale of 1-10 in importance, I’d say this was a 20. It generated a lot of knowledge among the associates that encouraged members to understand it and find it super easy.”

So that’s exactly what they did. “When we first launched, we left a two-week incubation period for associates to practice setting up appointments and understanding the system,” says Candy. It allowed their team to get comfortable using the software, troubleshoot customer scenarios, and iron out last- minute IT hiccups. As a result, after implementing appointments, KEMBA FCU grew its membership by 6% and loan production by 13%.

2. Make Next-Level Training Materials

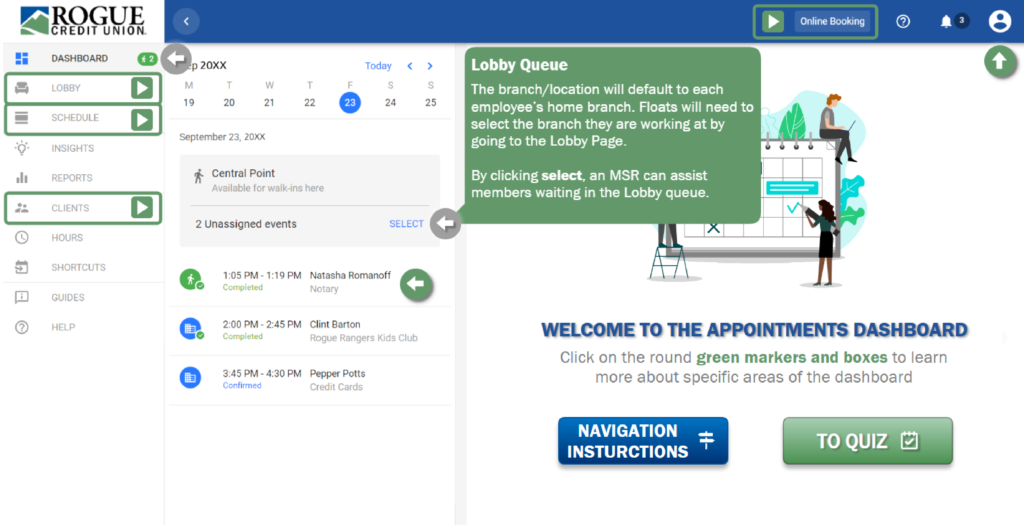

Your appointment software vendor will likely supply your rollout team with training resources. But your team knows how they learn best. That’s why the team at Rogue Credit Union created their own internal video course and skill-testing quiz as a prerequisite for gaining access to their appointments and queuing software.

The video course was a walk-through of the entire booking and meetings process for in-person branch staff, advisors, and call center staff. The course was based on the common circumstances they face while booking appointments, tracking actions, and serving members. And each team member passed the course by completing a quiz before they gained full access to the software.

The result was an overwhelming success. “The reaction from the team was incredibly positive—they loved how interactive and entertaining this training was and how easy it made learning the new software,” says Edwin Rivera, Member Delivery Administrator. At the end of their initial rollout, Rogue CU had an almost perfect adoption rate, ensuring everyone was at the same level of knowledge when they started serving members using the new software.

3. Pair Appointments With an Offer

Before using appointments, Addition Financial used to have its sales team call all new members. “Because many of those new members came from indirect channels, such as partnerships with auto dealerships, the connect rate was low—just 5%,” says John Ryczek, Director of Branch Operations.

John’s team knew their approach to new members needed to be different because they wanted to create a relationship that outlasted their short-term auto loan. So, they offered new members an opportunity to connect with an advisor 1:1 via a self-serve appointment scheduling link sent by email. Many members shared that those appointments were the only time a short-term lender explained their new loan, their payment options, and offered face-to-face service. And the results speak for themselves: Addition Financial’s connect rate rose to 25%.

4. Lean on Your Software Partner

The Rogue CU team thought they had a unique use case: They needed a way to assign float staff to various branches across their service area and track their schedules. During their rollout, they brought up this ‘wishlist’ feature to their implementation partners at Coconut, assuming the Coconut team would hear their feedback and put it on the back burner. “I was surprised to get the call that the technical team at Coconut had created a float functionality that could help us track staff scheduling across our branches,” says Edwin.

The lesson? Don’t be afraid to ask for support from your new software partner and offer your feedback throughout the process. You may not get a new feature, but your feedback may uncover a workaround or inform future software improvements.

5. Be Open to Change Post-Launch

Even if your implementation sails smoothly and your clients love it, there will always be areas for improvement. Managing change is part of your rollout too.

As Kristina Smith, AVP of Retail Operations at UMassFive FCU discovered, you should be tracking your rollout, and based on what you learn, update your approach. “We just launched a new service and one week later, adjusted the time frame to make this appointment longer. It’s hard to ask for more time, but that ensures you’re meeting everyone’s expectations, because if a member is there longer than they anticipated, and there’s a line, that’s not a good meeting,” she says.

Pay attention to feedback from members and staff as well as your platform data in the first few weeks post-launch. Set aside time to review your meeting methods, frequency of email reminders, and appointment duration. Your initial implementation ideas will likely require tweaking to make them even better.

You’re on a Roll With Self-Serve Appointment Scheduling

The goal of your rollout should be to create a seamless transition from old ways to new ones. Giving your team a long runway before your public launch, creating engaging training materials, and linking your appointments with incredible customer service are just a few of the ways appointment and queuing software users have managed successful rollouts.

Are you ready to navigate your own banking technology implementation? Let the journey begin.