How leading credit unions are tackling staffing shortages

The biggest challenge on credit union leaders’ minds right now is staffing. We’ve heard it in virtually every customer conversation we’ve had over the past few months. And our customers aren’t alone. Leaders from roughly four out of five financial institutions are worried about staffing shortages. So, how do you juggle short-staffed branches without compromising on member experience?

The short answer—it’s all about finding ways to reduce stress and workload on existing staff who are already feeling burnt out. That could mean offering members more self-serve options, shifting to virtual banking services, or starting to measure branch traffic so you can make smarter staffing decisions.

We know. It’s easier said than done. But, small changes can go a long way. We’ve gathered some of the strategies that our customers have leveraged to meet this challenge head-on to give you some inspiration on where to get started.

1. Offer pre-scheduled appointments

A big source of staff frustration is not knowing what their day will look like. Walk-in traffic is unpredictable, which means their schedules are unpredictable too. It’s hard for your advisors to have a productive conversation about a new mortgage if they aren’t sure who’s coming in, when they’re coming in or what their needs are.

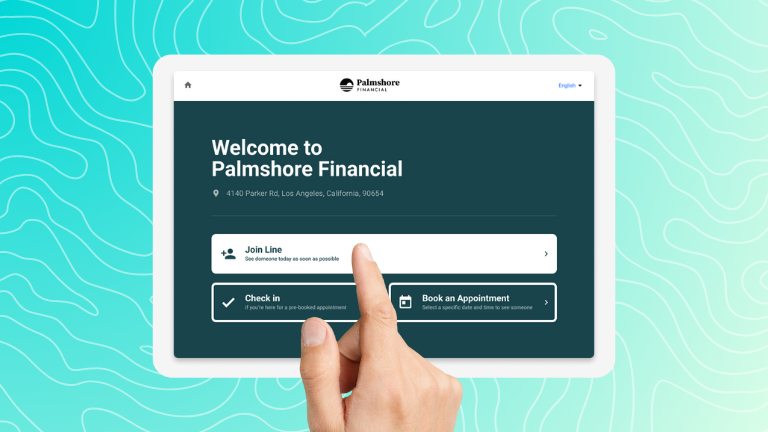

Introducing self-serve options, like appointment scheduling, makes it easy for members to schedule time with the staff member best suited to help them. No need to wait on hold or in a lineup at your branch. Which puts them in charge of their own experience. Allowing them to meet with staff when they want, and how they want.

It also gives your staff more visibility into their day. They’ll know who to expect, when to expect and can better prepare for those conversations. Which not only boosts NPS, but has also increased conversion rates for our customers 300% on average.

2. Use appointments to even out walk-in traffic

There’s nothing worse than hopping over to your credit union at lunch to wrap up that last detail with your advisor—only to see that everyone else had the same idea. Long lineups add stress for everyone. And it leaves your team struggling to deliver an exceptional experience, which shows in your NPS and wait times.

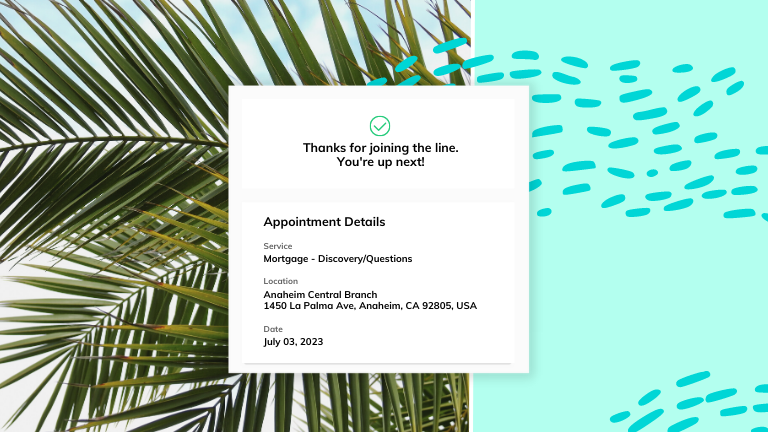

A few of our customers shared that they help even out the demand on their staff by reserving their busiest times for walk-in traffic only. Then offer pre-scheduled appointments outside of those busy periods, helping to fill in staff calendars during quieter times.

They also share current wait times on their branch locator pages, so members know how long they’ll need to wait to see someone. Allowing them to choose if they’d like to join the line, request a callback or pre-schedule an appointment before they even set foot in a branch. This flexibility helps to spread branch traffic out, reduce staff stress and has increased client NPS scores by 21 points on average.

3. Allow advisors to serve multiple locations

Advisors are in short supply, but they’re also critical to meet aggressive lending growth targets. To help deal with a shortage of these highly skilled staff members, many of our clients have assigned a single advisor to multiple locations.

This staff member often floats between locations throughout the week. But, one new trend we’ve seen customers adopt is the move to fully remote advisors. So advisors can serve multiple locations virtually, which reduces travel time between branches. Allowing advisors to spend more time building relationships with members instead of being on the road.

If a member walks into a branch and needs to speak with an advisor, many customers have set up meeting rooms equipped with laptops and cameras enabling members to join a virtual meeting. The key to making a virtual branch successful is ensuring that advisors are equipped with the tools they need to deliver an end-to-end experience that is consistent with your in-branch experience.

4. Develop a deeper understanding of your branch traffic

One thing we’ve heard over and over again from our customers is that pre-pandemic they were making staffing decisions based on gut feel. But, staffing shortages have forced them to really take a closer look at branch traffic. It’s virtually impossible to avoid over or understaffing if you aren’t sure how many members are likely to visit each day.

Leveraging appointment scheduling and lobby management solutions give you a central location to gather critical branch traffic data. You’ll unearth new insights like:

- How long the average branch visit takes

- How much time staff have between appointments

- When your branches are busiest

- Which branches are busiest

- When these branches are busiest

- Most popular reasons a member visits a branch

All of this helps you get more visibility into where your branch staff are spending their time, so you can spot opportunities to be more efficient.

Putting it all together

Staffing shortages aren’t showing any sign of slowing down. And every credit union’s staff and members will have slightly different needs. Finding the right strategies that work for your business will take time and the right tools.