How Financial Institutions Can Power Through a Recession With Better CX Tools

By nearly all measures, we’re likely headed into a recession. And this means people and businesses will soon be in cost-cutting mode. There will also be less demand for lending—especially mortgages and home renovations.

What can financial institutions do to keep clients calm—and revenue steady? Double down on your investments in customer/member experience (CX). It’s the best way to weather the storm by:

- Continuing to attract new clients

- Retaining and growing existing clients

- Reducing operational expenditures

This article will explain how. We’ll share 15 ways a few strategic investments in CX tools (like self-serve appointments and queuing) can help your bank or credit union power through a down economy—and help your customers and members do the same.

In a Recession, Customers and Members Want Quick, Easy Access

First, let’s take a minute to view this recession through the eyes of your clients. People are already watching friends get laid off, inflation eat into their earnings, and interest rates spike. Right now, they’re probably feeling shook.

What will they do? History suggests they’ll hunker down. They’ll cling to familiar brands. They’ll spend less on dining, travel, furniture, home projects, and automobiles. Many will look for advice on maintaining their standard of living.

But that’s just those who are already in a good spot. Others will fare less well, and this stress may tip them into what’s known as a “scarcity mindset,” which is a spiral that leads to increasingly poor financial decisions like:

- Saving even less

- Taking loans at higher interest rates

- Struggling to weigh long-term consequences

Everyone across this continuum will need your advice. A recent 5,000-person survey by Personetics found that 51 percent of consumers want more advice from their financial institution on managing their money and 66 percent want proactive financial insights for their financial stresses. But 63 percent haven’t received any communication or advice from their bank on how to weather this financial storm.

Similarly, a JD Power study found that 63% of customers won’t switch banks and 78% will reuse their current bank—if it delivers support to them during challenging economic times. But only 44% say their institution is delivering.

The easier it is for people to engage your staff and advisors, the easier it will be for you to provide that support and solidify your relationship with new and existing clients. And excellent CX tools are the key to making it happen.

15 Ideas for Faster, Friendlier, CX That Eliminates Barriers

Who is easier for stressed consumers to reach: you or a fintech app? Consumers will always choose the path of least resistance. So, if the barrier to reaching your loan officer, talking to someone at your branch, getting a question answered, or booking a meeting is low, you’ll unlock a flood of valuable interactions.

But today, many financial institutions make connecting with the right staff, tool, or product harder than it needs to be. Booking an appointment requires back and forth. Branches have unpredictable wait times or staff available to chat. Video calls aren’t available, or are difficult to join. Moreover, staff at these institutions can’t prep for meetings or see traffic trends to make better experiences. The list goes on.

By investing in CX technology that gives clients more choice and speed along with how or where they interact with you, your institution will grow, retain, and excel at a time when others who haven’t modernized are declining. Below are 15 ideas for doing it with the right tools.

Customer or Member Banking Experience Tools to Invest In

- Real-time appointment booking

- Chat capabilities

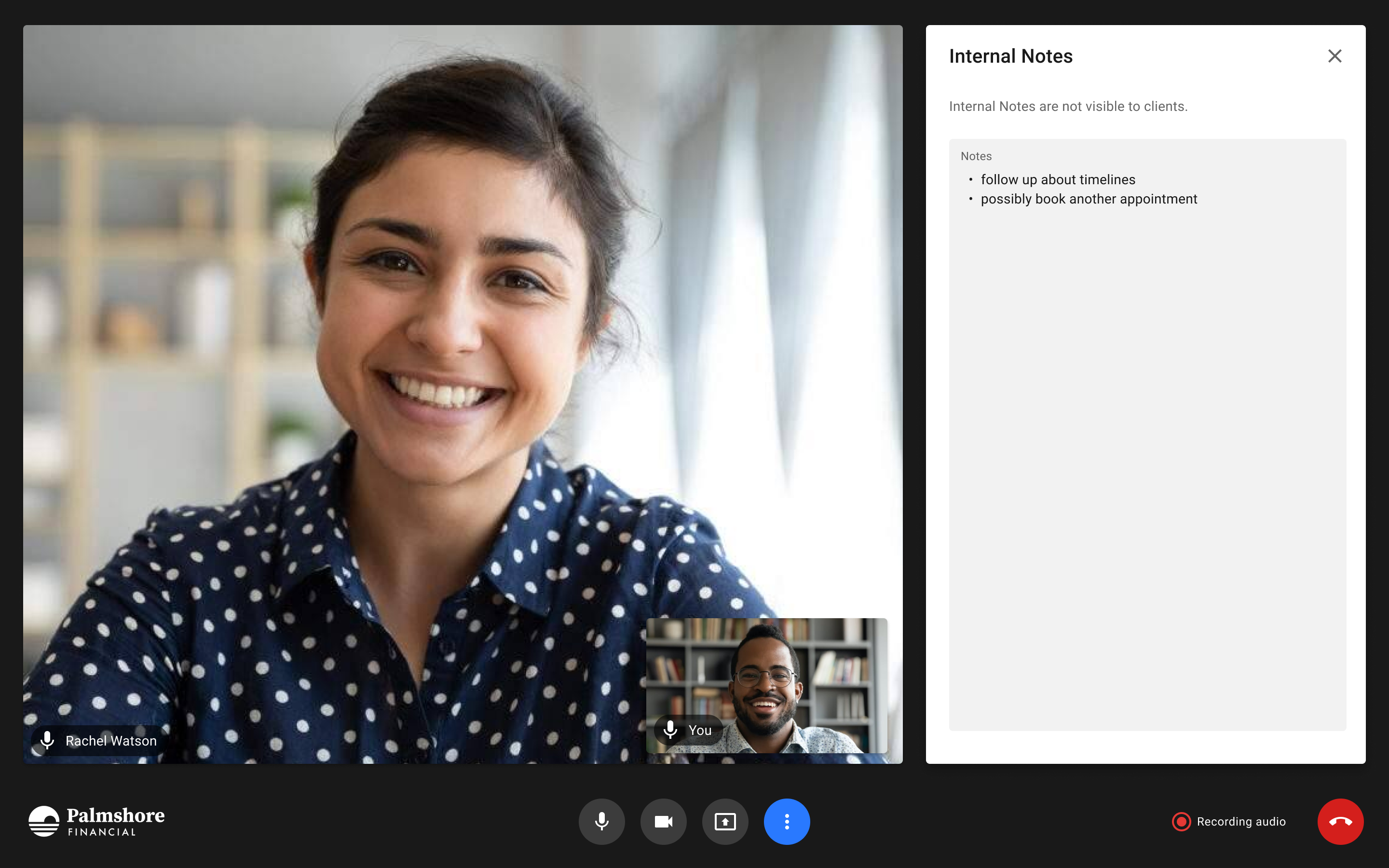

- Video banking

- Self-serve queueing (in-branch and virtually)

- Online account management tools

- Smarter mobile app CTAs and notifications

- Meeting and traffic data reporting to understand trends

Attracting New Clients

1. Run a competitive campaign around your lower rates—Consumers are worried about rising interest rates. Show that yours are lower and offer to help them consolidate debt or refinance. To make it really easy to respond, include a link in your email or ad that lets them book time directly on the correct person’s calendar. And to make it doubly easy, let those clients take it as a remote video call, so they don’t have to drive in.

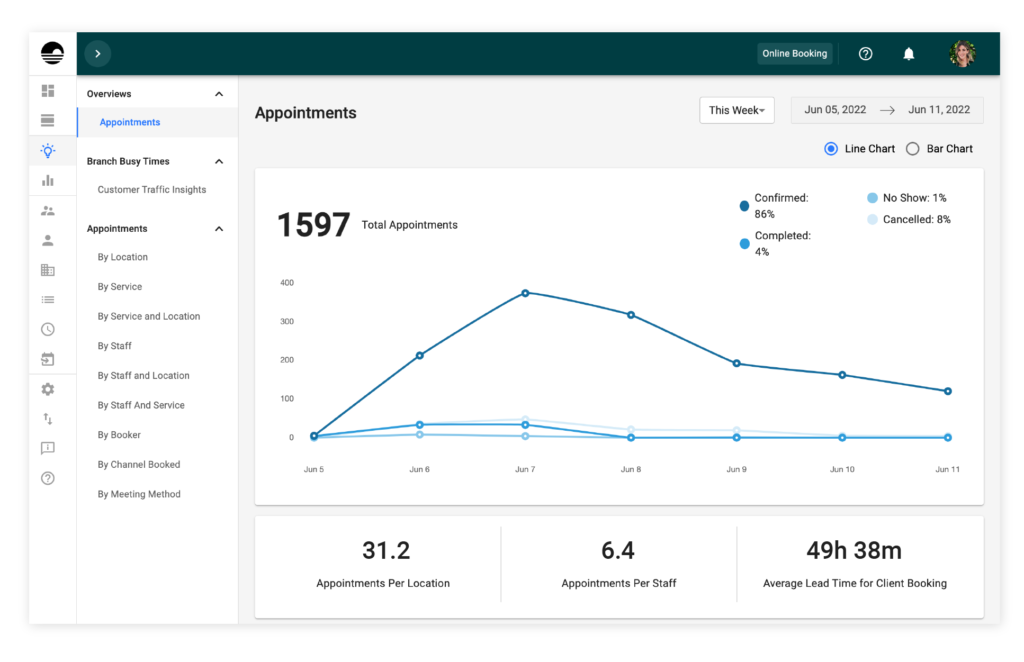

2. Cut wait times with traffic data—An appointment and queue management system that gathers both online and in-branch traffic data can show how many staff are needed where. That’ll help you reduce wait times and make entering a branch more appealing.

3. Enter new regions with a virtual branch or services—Consider opening a virtual branch where you want to gain a foothold in a new market. The key is having remote employees to service the area and video banking tools to make connecting feel like the in-person experience. (As a bonus, you can also push overflow and video call traffic here for support or service.) Read our primer on how to launch a virtual branch here.

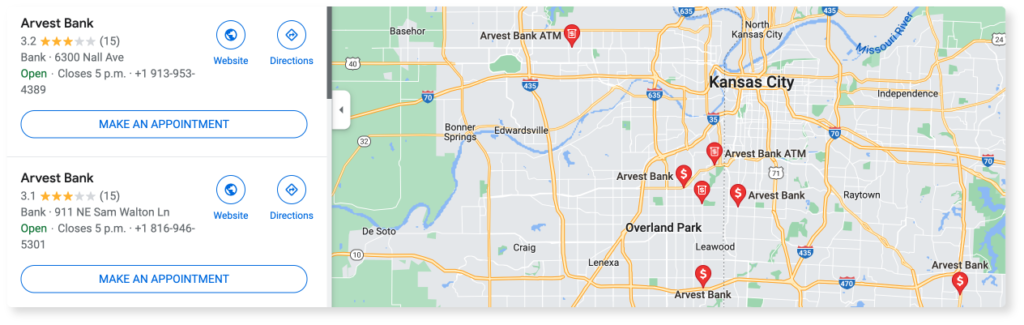

4. Use meeting data to optimize your ads—If you run Google Ads that allow people to book an appointment, you’ll have data on your appointment conversions by channel. You’ll know what types of ads/products were interesting, and the downstream data on which appointments were successful. You can use that to run more targeted ads.

5. Hold financial education webinars—Have advice for managing credit or consolidating debt in a downturn? Start holding virtual events for new and existing customers or members to build brand affinity and loyalty from the get-go. Video banking tools can often have a number of participants attend, so consider using your video calling tool for a personalized, convenient small-group experience.

Retain and Grow Existing Clients

6. Offer proactive, empathetic consultations—Have your team reach out to at-risk or delinquent customers or members with an offer to meet for support when it’s convenient for them. You’ll probably already know which ones are distressed based on your know your customer (KYC) system. If that person is deciding which loan or card not to pay off, a strong relationship can tip the balance in your favor. Consider also adding complimentary financial consultation CTAs to your website and mobile app that lead people to a simple, real-time booking calendar.

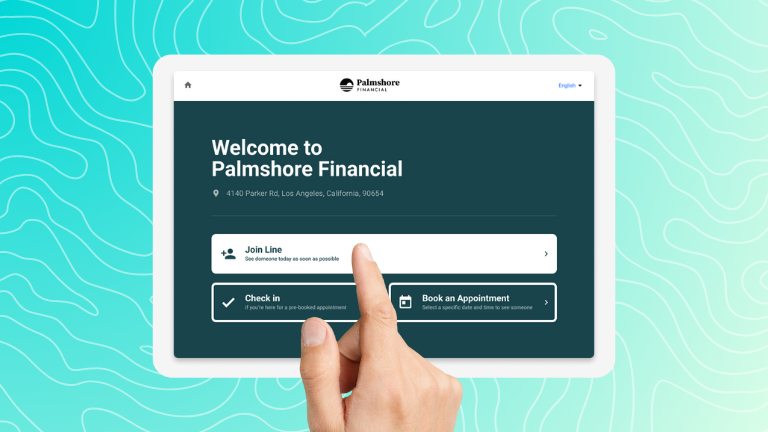

7. Use in-branch kiosks or greeters to promote self-serve options—Lower people’s anxieties by offering immediate help. A kiosk or greeter with an iPad can check people in, resolve some issues upon arrival, book them an appointment for a convenient time, or route them appropriately. And an online appointment booking system lets you take requests 24/7, so people who are up late poring over their finances can rest easy knowing they have a time booked.

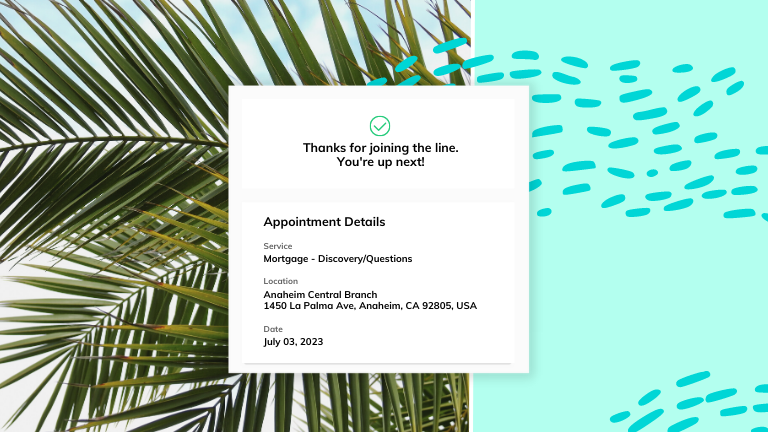

8. Manage a central online/in-branch queue to offer accurate wait times—Reduce everyone’s stress by showing them exactly how long the wait is, whether they’re online or in a branch, with self-serve queue management tools. This can be at a kiosk or iPad in your lobby, or a virtual queue online. Letting clients quickly sign in, receive next-in-line notifications, join a queue, or book an appointment for a later time (including virtual calls) shows that you value their time—and makes engaging with you a delight—instead of a potential time waster.

9. Offer fast lanes or curbside service for customers or members—CX tools like appointment booking or queue management often let people tell you what their issue is ahead of time. With this data, you can route those requests based on need or service type. If someone needs a simple transaction completed, they can visit a “fast lane” in-branch or request curbside service. Delighting customers with fast, accessible services will earn you tons of loyalty now and for the future.

Improve Staffing and Cut Operational Expenditures

10. See traffic trends to better resource branches and staff—Good CX tools (like appointment and queue management) help you understand branch traffic patterns through reporting. You can use that to staff more accurately, for greater labor efficiency, and to also make tough calls about whether to open or close branches. Plus, automated appointment reminders reduce no-show rates—thus preventing overstaffing and wasted advisor time.

11. Better train staff and understand their productivity—Better CX tends to mean more data. You can use appointment tools to understand staff productivity via measures like appointment volume, length, and products closed per engagement. Virtual call transcripts can also help you analyze performance and identify training opportunities more easily.

12. Reduce support costs with better self-serve options—Sometimes, great CX means letting clients do it themselves. Lots of smart meeting and queue tools include CTAs options that redirect customers to self-serve channels. When finding who or what your clients need is simpler and faster, you lower your support costs and queues.

13. Reduce admin work and increase staff capacity—With automated appointment and queue management software, frontline staff spend less time managing meeting reminders, calendar invites, or long, unexpected lines. And with video calling options, advisors save time on travel between branches—meaning they can handle more meetings remotely. And thanks to intake questions, advisors come prepared to address clients’ specific needs (vs. asking at the start of an appointment). Plus, clients get reminders about which documents to bring with them—all of which leads to shorter appointments and time-savings for your team.

14. Track follow-up tasks and actions to increase conversion/completion rates—Great client-management tools can often help you staff track actions, or let you assign actions to your staff, with reminders. Handing these reminders over to the system ensures people don’t forget, and all that outreach and next steps are completed. (Lots of appointment management and video banking tools track notes and next steps. They can also integrate with your Customer Relationship Management (CRM) system for better follow-up.)

15. Use customer/member data to better market and sell your services—If you have data on which appointments or products are popular, you can infer what’s trending or useful and double down—or spot problem areas to address with better messaging, support, or self-serve options. Plus, when you have more data on in-branch and online engagements, it’s easier for advisors to get a fuller picture of the client journey and come to meetings with more personalized product or service recommendations.

Make an Impression Despite the Recession

Banks and credit unions that successfully navigate this looming recession will do so based on having a better experience for customers and members. The easier you make it for clients to interact with you, the easier time you’ll have keeping growth, retention, and revenue chugging along smoothly.

And the more clients learn they can reach quick and easy help, the more you can be there for them—now and long after a recession passes.