About Rogue Credit Union

Rogue Credit Union was established in 1956 by a group of teachers to serve their member-owners and community. Since then, Rogue has grown to 27 locations across Southern Oregon, a membership of 166,000 and over $2.5 billion in managed assets.

With deep roots in the community, and an expanding base of members, the leadership team realized that they needed to speed up their digital transformation. Members were unable to book appointments with staff and had no reminder notifications available, management did not have line of sight into appointment results and statistics, and member walk-in experiences were disorganized.

Rogue’s Challenges

The management team realized that in order to improve their member experience, as well as drive branch efficiency, they needed to get a better understanding of operations through data. Rogue is a firm believer in measuring their success through the positive difference they make for others – ranging from their deep community involvement and volunteering, to their member experience, both digitally and in-branch.

Challenge #1 – Friction coordinating and tracking engagements between Staff and Members

Gina Jorgensen, AVP of Member Service, states, “We had no appointment scheduling prior to Coconut. Members could schedule with staff only if they happened to be in direct contact already, or through our contact center associates who had to call each location to confirm staff availability.” This self-imposed friction made it difficult for staff and members to engage quickly to resolve questions and take action. And without being able to track appointments, branch managers did not have an effective way of staffing their teams.

Meetings were often cancelled last minute or resulted in no shows as there were no automated notifications or reminders for staff and members. “We had members walking out of our branches each day because of waits. We didn’t track this other than through frontline notes and NPS feedback, so we’re not sure the full scope of what we missed out on,” Jorgensen states. The opportunity cost of this rework and ineffective use of time resulted in real reductions in revenue and an increase in costs. “Our members didn’t have much control over their experience… we realized we needed to provide the level of experience that they were used to getting in other industries, like healthcare.”

Challenge #2 – Limited line of sight to location/staff performance

As there was no formal appointment booking process or software. Walk-ins to Rogue’s 27 branches were the norm and prioritized due to the sense of urgency to provide immediate help. However, “Branches were struggling with the management of wanting to make appointments, but not having any time to schedule in between walk-ins.” Staff wanted to back fill available time with appointments but did not have an efficient process to do so. Thus, branches were at the mercy of when walk-ins happened to occur.

With no standardized software, Rogue’s management team also had no visibility into appointments that included tasks or activities that didn’t hit their banking infrastructure. For example, any meetings that occurred for notaries, questions on accounts and fraud investigations had no tracking but were an important use of staff resources. The only way Gina and team could track what had occurred, was to tally the tasks that required paperwork and processing: loan applications, opening new accounts, etc. Thus, a huge amount of the work that staff did on a regular basis was not being tracked and therefore couldn’t be measured nor managed for improvements.

Lastly, with minimal reporting, management was not able to optimize their workforce – staffing was more reactive, historical trends on branch and service traffic unclear and projections into what future trends and behaviors couldn’t be made. A key requirement when creating Rogue’s strategic vision.

Derek Reeser, Member Contact Center Manager, at Rogue states, “It was very hard to predict when members were going to come in through the door, or predict how many staff members you needed on a daily basis. You also had no idea of how long things took, or what things that your team was working on.”

Challenge #3 – Improve member experience across all channels

In addition to flexibility in booking convenient appointments, Rogue’s members were also expecting to be supported through multiple channels – online, mobile devices, in-branch and via the phone. In order to do this at scale, Rogue needed to automate portions of their operations, particularly meeting scheduling, follow ups and integrations with other existing systems. “We reviewed the market and other financial institutions… and found many others were offering members flexible booking options.” Jorgensen continues, “Members must be able to interact with Rogue when and where they want.”

Rogue’s Solution

Rogue evaluated two other vendors and decided to partner with Coconut Software because of the flexibility and willingness to accommodate Rogue’s specific requirements. Gina states, “From the initial demo (which was in Rogue branding), it was clear that there was a willingness to invest and partner with us… the other vendors didn’t have the same level of flexibility to make changes or allow for customizations that we felt we needed.”

With Coconut’s built for banks and credit unions platform, Rogue was able to customize and configure their setup and support to meet their exact needs.

They also knew that it was key to choose a partner who would continue to provide exceptional support throughout: during the sales process, through implementation and after Go Live into the future. “When the implementation of Coconut Software was done [in December 2019], we knew the attention and support wasn’t going to be over,” Gina states, “it was a good culture fit.”

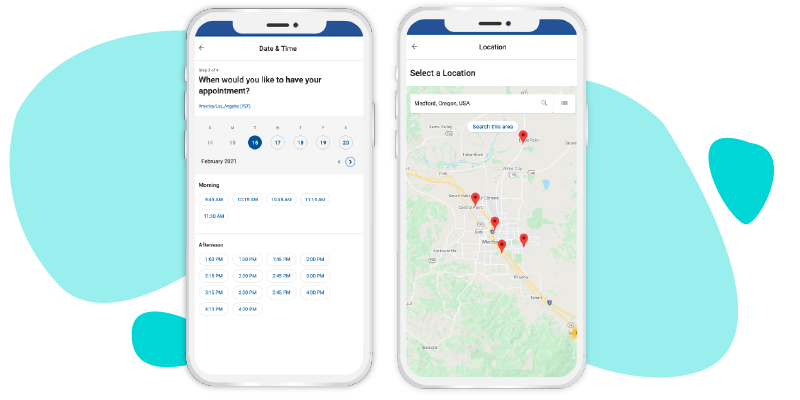

Solution #1 – Appointment Scheduling

Rogue is able to seamlessly integrate with their Outlook calendar set up and other supporting systems. This allows the team to automate and streamline management of the high volume of member engagements, such as appointment reminder emails and SMS texts, mobile check-ins to maintain social distancing, as well as insights to see how each branch, staff member and service is performing.

Solution #2 – Lobby and Visitor Management

By implementing Coconut’s Lobby and Visitor Management solution, Rogue has been able to manage their foot traffic throughout their branches. With Coconut’s proprietary algorithm, Rogue visitors can see the wait time and reduce lobby abandonment through check-ins (speaking to a greeter or through their mobile device) and easy appointment booking. Analytics and reporting provide Rogue with data into how wait times are affected by traffic mix and which locations need more (or less) staffing through average handle time.

Rogue’s Results

Results #1 – Reduction of engagement friction through improved process efficiency

Implementing Appointment Scheduling immediately saved staff and members time, by allowing members to book an appointment through their preferred channel. Contact center associates now have full sight into staff schedules at all locations in a few simple clicks, eliminating the need to call each location to confirm availability. Additionally, the streamlined scheduling experience allows members to self-book an appointment online at their own convenience. In the first year of implementing Coconut, Rogue saw over 51.6k branch appointments scheduled in 2020. “We rolled the Coconut solution out at exactly the right time… our members took to it pretty quickly.” Automated notifications and reminders help keep members informed of upcoming appointments, reducing no shows and allowing members to reschedule cancelled appointments. Of the total number of appointments booked only 10% were a no show and 9% cancelled, significantly lower than industry averages and especially good considering the pandemic.

Over the same time, Coconut’s Lobby & Visitor Management solution has helped Rogue manage their 35.5k walk-in engagements. Members can also see wait times, join a queue or check-in for a pre-scheduled appointment. In a 3-day period alone, Rogue managed nearly 11,000 interactions as a result of their participation in the Oregon Emergency Relief Funds disbursement program for those most impacted by COVID-19. “During the COVID-19 crisis we were able to help our members and disburse Oregon Emergency Relief Funds from the state. Originally, we had planned to roll out this support with pen and paper, but we pivoted the day before to digital engagements on iPads across our branch network – it was a really big deal.”

Coconut Software has also helped Rogue engage with members over the phone, starting in March. “Originally, we weren’t intending to use phone calls for appointments, but with the pandemic we needed to switch over quickly. Even still, with all our branches open, nearly 30% of our appointments are over the phone. We expect that this is a new behavior that’ll continue even after COVID-19 is done.” Since implementing phone calls for appointments in March, Rogue has completed just over 10k calls, allowing for increased convenience for both staff and members, as well as a shift to a lower cost support channel.

“We rolled the Coconut solution out at exactly the right time… our members took to it pretty quickly,” states Jorgensen.

Results #2 – Improved reporting and insights

With clear insight into staff and location performance with Coconut’s centralized reporting, Rogue’s management team can now make informed decisions and optimize their workforce. Management receives a complete, real-time view of branch traffic and scheduled appointments at each location. They can track how long members have been waiting in-branch and how many have abandoned the queue when they weren’t being served quick enough. Additionally, they can see not only which hours, but which days are the branch’s most popular and can adjust staff accordingly. “[Coconut] will help us run our branches more effectively, staffing based on appointment and busy times. We had no idea how great the timing ended up being for this partnership.” 100% of appointment taking staff are now using Coconut, with an average of 354 appointments per staff member for 2020, or just under 9 per week.

Rogue’s management team is also able to track all the work staff does on a regular basis that was not previously tracked such as notary meetings, questions on accounts and fraud investigations for a complete view of staff’s days. Between Jan 1, 2020 through August 31st, each staff member performed roughly 3 appointments per week. This work can now be measured and managed for improvements. Reeser continues, “Coconut gives us the tools needed to try and predict our volume, and to be more efficient and better organized.”

Results #3 – Better member experience

Members are served when, where, and how it’s convenient for them. By making it easy for members to speak with the right person to meet their needs, they become more engaged and leave satisfied with their experience. “Our members are gravitating towards being in charge of their experience – not having us tell them how they’ll have an experience. The more we offer them flexibility and engagements when it’s convenient for them, the more we’ll be able to grow and provide an exceptional member experience.” Kacie Harmon, Branch Manager, agrees, “Before we were unorganized which caused scheduling stress! Now we have the organization to our day that allows us to better serve our members.”

Rogue leverages member experience surveys in addition to NPS surveys to gauge the results from projects such as this one. “We have continually received positive feedback from our members! Here are some positive themes we regularly hear about: how fast and easy the process is, the minimal wait times, availability of appointments, appointments are on time, appointments are efficient, and that the experience was quick and smooth.” Rogue’s most recent results are an average of 83.5 for NPS June through September 2020 from a survey specific to their members that had the Coconut experience. Jorgensen is pleased with the results so far and is looking forward to gaining additional insights to assist with optimizing staffing levels and process improvements.

Conclusion

Jorgenson and the rest of the leadership team will be reviewing results at the individual branch and entire network level in order to help plan for Rogue’s future in 2021 and beyond. While the future of financial services remains unknown, they can rest assured that Coconut will be there to provide them with the data, understanding and insights needed to meet, and exceed, their goals for digitally transforming their operations.