Virtual Meetings: Keep Calm and Connect Remotely

The global pandemic caused by the Coronavirus (COVID-19) has impacted nearly every corner of the world. For ourselves here at Coconut, we are lucky to have been able to allow all employees to settle into their remote working environments while continuing to serve our customers. We understand that we are lucky to have the ability to continue providing guidance and solutions to the issues this global crisis has imposed on them, their staff, their customers, and their way of life. Because we know that not everyone has the same option to switch to a work-from-home business model.

They simply do not have the tools in place to make it possible.

As countries around the world order businesses to close their doors and send workers home in an effort to flatten the curve, many citizens are feeling unprecedented levels of uncertainty about their future, as well as what that will mean for their finances. And with experts estimating that the total cost to the global economy is estimated at $2.7 trillion, they are not alone in their concerns. Everyone is affected, and everyone is looking for direction during these difficult times.

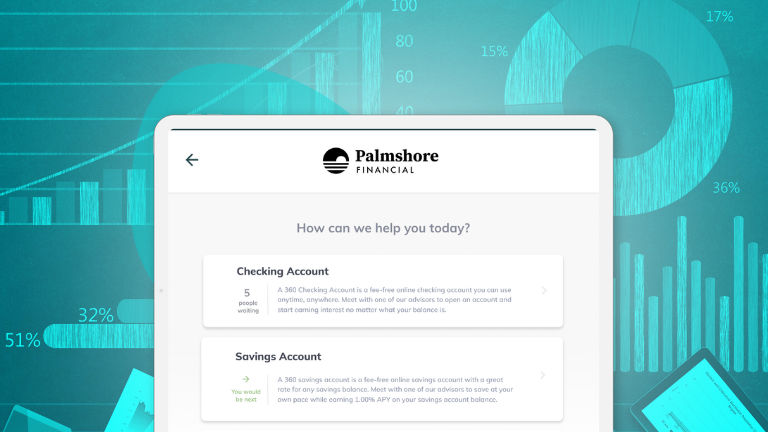

This is why we pushed ahead with a priority release of our Virtual Meetings integration, a new feature that allows banks and credit unions to quickly and easily shift from traditional face-to-face meetings to a remote business model. Building on the core functions of our existing customer engagement solution, Virtual Meetings can help customers and advisors to continue their relationships in a digital setting, allowing them to communicate safely and securely from any location.

Through a seamless integration with video conferencing providers like Zoom, customers are able to schedule their virtual meeting quickly and intuitively. And for those who prefer a more low tech solution, the ability to schedule a meeting over the phone is also available. All of this is available through the same self-service booking flow used for face-to-face meetings, and with no software to download and no need for customers to set up accounts, adoption is incredibly simple.

Within just days of its release, 20 of North America’s leading banks and credit unions have enabled the new integration, with the Coconut team working tirelessly to help them navigate this newly imposed digital world. And as many branches are forced to close their doors, Coconut’s clients have expressed their appreciation for its rapid delivery.

“This is a great example of providing a solution that is a real and present need due to the challenging and uncertain times we are in. We are still in the process of closing our branches due to the need that is still very present in our community, but will be shifting to using [Coconut Software’s Virtual Meetings integration] to help us do more remote video appointments very soon now.”

Jeanne Pickens

COO, Rogue Credit Union

Following from our mission of “powering human engagements in a digital world”, remote meeting capabilities come as a natural evolution of our current offerings, and one that is needed today more than ever. Even prior to the current situation, the ability to connect remotely is something that has been increasingly important to our customers in the financial world. But now, with financial institutions and the customers they serve facing these unprecedented challenges, it’s more important than ever for us all to work together in keeping the lines of communication open. This is why Katherine Regnier, CEO and Founder of Coconut Software, has made the decision to provide this feature at no cost during this time of need.

“Where digital customer engagement was previously viewed as a competitive advantage, it is now a requirement to keep customers and staff safe with physical distancing and managing foot traffic. It has made our solution a necessity.”

Katherine Regnier

CEO and Founder, Coconut Software

With both financial institutions and their customers experiencing the full physical and financial effects of the current global crisis, it’s vital that banks and credit unions are able to continue to provide direction and reassurance — while also encouraging increased physical distancing. Whether they accomplish this through enabling staff and customers to meet remotely, or by simply reducing and managing foot traffic by switching to an appointment only business model, we have a solution ready and waiting to help see you through these days, and beyond.

From all of us at Coconut Software, stay home, stay healthy, and stay in touch.

What Next?

Looking for more strategies to meet your customers’ changing expectations? Download our report Becoming Future Proof: Five Proven Strategies for the Branches of the Future to learn more methods in technology, design, and service that banks and credit unions can take advantage of in preparation for the future.

Interested to hear what top experts in financial customer experience have to say about the coming challenges branches are looking forward to? Watch our panel discussion Embracing a Customer-First Mindset: Eliminate Friction Points in Your Customer Multi-Channel Journey.

Ready to start taking steps to ensure your business is set up to meet future challenges head on? Schedule a consultation with Coconut Software to learn more about how our tailored solutions can help.