Café Branches: Future Proof Branch Strategies

Branches will always be important to clients. Major financial decisions like mortgages, loans and financing will always benefit from having a human on the other side of the table. Research has shown that 84% want access to a live person to discuss banking needs, and the same percentage expect that they will expect to need the same five years from now. And as demonstrated by the chaos caused by the recent outage at leading branchless bank Chime, having a physical branch available can make life a lot easier at times. Yet branch closures continue to rise, with 1,947 shutting their doors in 2018. So the question is, how can banks evolve in order to remain relevant in the years to come?

As a follow up to Part 1 in our series, today we will be examining the 2nd of 5 different strategies that banks and credit unions can implement in order to set their branches up for success in this rapidly changing landscape.

Revitalize the Lobby Experience with Café Style Branches

To create an in branch experience that customers actually enjoy, it’s important to improve the physical environment and make the atmosphere more conducive to human interaction. Some contemporary banking providers like ING Direct (now Capital One) made the radical decision to entirely eliminate transactions from their branches, turning them into pure cafés. Such concepts were originally far and few between, and those that tried them were often ridiculed.

That was then. This is now.

![]()

More and more customers are embracing the idea that banking doesn’t need to be purely transactional, and many financial institutions are converting customer spaces in their branches into “third places” — comfortable locations between work and home where people can meet and hang out.

“Our customers expect the digital tools that allow them to bank wherever they are. But they also expect to have a person to talk to when they need it. The cafés are a unique opportunity to present a physical manifestation of our brand and take this as an opportunity to connect with customers on their terms.”

Mike Friedman

Market Lead, Capital One

The idea behind this movement is to encourage the most important aspect of the branch that sets it apart from increasingly popular digital options — human interaction. And it does this by removing the barriers that have traditionally been in place. This change doesn’t necessarily need to mean converting customer areas into a full blown café either. Through a self-service kiosk as mentioned in our previous post, space that would otherwise be taken up with queueing customers, greeter stations and tellers standing behind a counter can be utilized to create a more open and inviting area. Think of an interior design featuring fewer walls or straight edges, introducing more round tables and comfortable seating, and you have a space that’s less of a ‘lobby’ and more of a comfortable lounge that encourages conversation and interaction. At the same time, mobile technology can be implemented in order to allow staff to roam about ready to answer questions, provide transactional services through tablets, educate customers on self-service options and direct them to private meeting areas to speak to advisors.

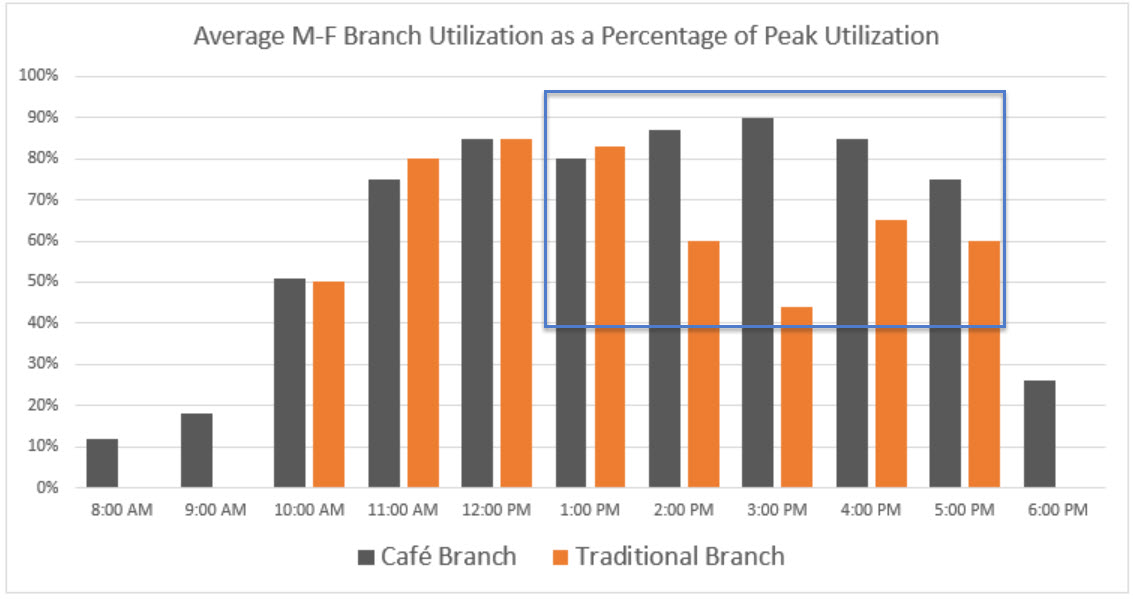

By providing customers with this welcoming, conversation driven space, you can not only increase the value of customer interactions, but increase their number as well. In a study on branch traffic at traditional vs café style branches, the boost is readily apparent.

For traditional branches, traffic typically peaks at around 11am and/or 12 pm and again at 4 pm, creating a noticeable decrease in traffic between 2pm and 3pm where staff is being under-utilized. The café branch on the other hand sees consistent traffic throughout the day. Not only that, but customers would stay for longer periods of time. Where the average bank customer stayed an average of 15 minutes in the traditional branch, in the café branch they were staying for an average of 45 minutes. More time spent in the branch provides more time to build a relationship with them. So if that’s your goal, it’s clearly a big advantage.

Looking back at the Capital One example, they have taken advantage of the relationship focused environment and increased branch traffic provided by their cafés in order to offer free money coaching sessions. Described as judgment-free consultations designed to help people align their spending and financial management with their own values, beliefs and goals, Capital One says over 5,000 individual money coaching sessions have taken place all over the country. All with absolutely zero marketing push from Capital One.

“It’s more like a partnership,” says Lake, 32, who is a home loan specialist living in Boston. “You want your personal trainer, your CPA and you want your financial adviser but I want somebody to be there more as a coach than as someone telling me what I should be doing. Because I don’t feel like I’m on a traditional path, and I don’t think I’m alone in that. … (Millennials) want someone that sees us as individuals rather than as a stereotypically corporate worker.”

Considering that these coaching sessions fit so well with what millennials are looking for as they learn to better manage their financial wellbeing, this no pressure, no judgement tactic is an excellent method for building relationships with both existing and potential customers. And with redesigns to the lobby that get more customers coming through the door, spending more time inside, and feeling more comfortable while they’re there, you have that much more opportunity to begin.

Check out the other articles in the Future Proof Branch Strategies Series:

PART ONE – Self Service Kiosks

Examining the benefits and capabilities that self service kiosks can bring to your branch by eliminating many of the pain points that customers associate with their visit.

What Next?

Looking for more strategies to meet your customers’ changing expectations around the in-branch experience? Download the full report Becoming Future Proof: Five Proven Strategies for the Branches of the Future to learn more methods in technology, design, and service that branches can take advantage of to adapt in the rapidly changing financial landscape.

Interested to hear what top experts in financial customer experience have to say about the coming challenges branches are looking forward to? Watch our panel discussion Embracing a Customer-First Mindset: Eliminate Friction Points in Your Customer Multi-Channel Journey.

Ready to start taking steps to ensure your branch is set up to meet your customer’s evolving expectations head on? Schedule a consultation with Coconut Software to learn more about how our tailored solutions can help.