10 Ways to Drive More High-Value Bank Appointments

Most financial institutions underestimate the power of pre-booked appointments. Banks and credit unions that use appointment and queuing software attract new members, grow revenue, and delight customers—not to mention automating admin processes across the organization. The ROI is undeniable.

But, how do you get your current and potential members to book more appointments? Once you get an efficient process for booking high-quality meetings up and running, it’s time to run campaigns to get more people scheduling appointments. That’s why we’ve compiled 10 tips to increase your number of high-value meetings by promoting them online and off.

Want to see 31 ways to generate high-quality appointments? Read our Appointment Growth Guidebook. 🚀

5 Digital Marketing Tips to Increase High-Value Meetings

- Advertise appointments on your website and app.

Use pop-ups and banners to inform members about meetings—directing them to appointment links to mobile-friendly landing pages. Drop your appointment link in your in-app help center for those needing support, or at the bottom of product pages to catch members who need help sorting through options.

Beyond putting appointment links in places like your website top navigation bar, “find a location” page, or support page, you can also use pop-ups and banners to run appointment campaigns. Run several campaigns at once in different online locations to test offers, like seasonal promotions.

- Use Google Ads to let people directly book meetings.

Use the feature Reserve with Google which allows anyone searching for your financial institution to easily book time with your staff from their browser’s search results. (They don’t even have to click through to visit your website.) Go even further by using custom links based on your potential client’s search intent. For example, direct those who searched for “auto loans” to your loan department, or “small business account” to your small business department.

- Launch email and social media campaigns.

When running a campaign include custom booking links or QR codes in your social media posts or signage. When anyone clicks that custom link they’ll be able to book directly with an advisor right from their phone. Take it from our friends over at Yolo FCU. They launched a social media refinancing campaign and saw a 12% increase in auto loan appointments and a 120% increase in refinancing appointments.

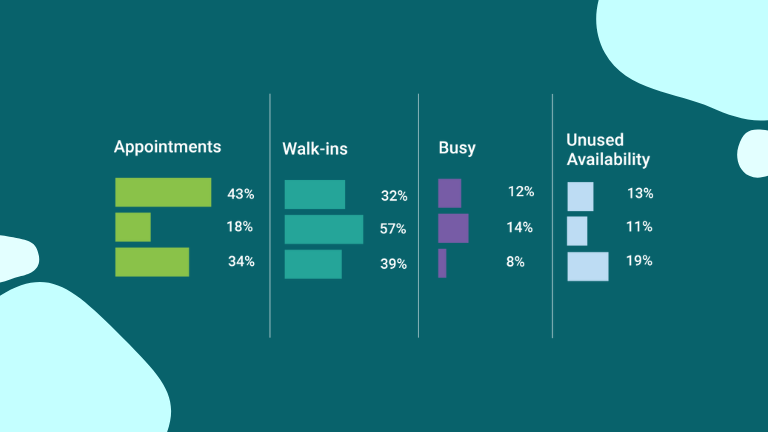

- Share appointment data to show when branches are busy.

When your branches accept appointments via an appointment and queuing tool, it generates valuable branch data. For example, when Arvest Bank launched its appointments feature, they suddenly had insight into 47,500 meetings and could estimate how busy their branches would be.

You can use this to share the data on your website, in your app, and Reserve with Google. It’ll help clients know in advance when to book a meeting, help your staff manage walk-in traffic, and leave each client feeling more confident in your service experience.

- Send automatic email and SMS confirmations.

Don’t let forgetfulness get in the way of high-value meetings. The best practice is to send at least one automatic email or text reminder a day before, and at least one hour before a client’s scheduled appointment. This helps clients trust your appointment program—they’ll know if they set an appointment, it’ll happen and they’ll get their questions answered.

5 Offline Tips to Drive More High-Value Meetings

- Let walk-ins know they can schedule an appointment next time.

Institutions rely on walk-ins as the engine that powers appointments. “Whenever we open new memberships, if they didn’t find us through the website and schedule an appointment, we let them know that if they need any services in the future, they can schedule an appointment from our website,” says Candy at Kemba FCU. Train staff to always let walk-ins know that next time, they can book an appointment and skip the queue.

- Survey members to understand appointment experience.

Add appointment-related questions to your ongoing customer experience surveys or as part of your frontline staff’s in-person protocol for the next quarter. Ask what you might improve about appointments, and share the results with your staff.

Questions to ask:

- Have you booked an appointment recently?

- How would you rate that experience?

- What can we do to improve it even further?

- Train staff to drive value towards appointments.

Don’t assume all staff know what makes a good appointment. Take a “train the trainer” approach and create materials to train people managers—they’ll in turn coach their team on what makes a good appointment. Also, find your volunteer “champions” who are excited about your appointments program and want to help guide their colleagues.

Ideas:

- Create an appointment playbook and FAQ, and designate someone to maintain it

- Designate champions and trainers

- Develop an internal certification program

- Incorporate appointment management into performance reviews

- Use in-branch displays.

Displays like TVs and welcome tablet kiosks are there to guide people to the right options. Use them to your advantage. If the wait is long or growing longer, TVs or iPads can show wait times and a CTA to book an appointment now (to avoid the line entirely) or book an appointment in the future (to avoid it next time).

- Offer incentives and prizes.

Who doesn’t love a little gift? Offer your credit union’s branded clothing, mugs, gifts, or rewards to clients who book their first appointment or book your team’s 100th meeting. Consider running raffles and draws where only clients who book appointments ahead of time are eligible. Some of your prizes could be:

- Coffee mugs for members who book their first appointment

- Holiday-themed prizes for booking the first (or first 100) appointments in seasonal months

- Gift cards for appointment referrals

- Handwritten thank you note from the advisor they met

- Coffee mugs for members who book their first appointment

- Holiday-themed prizes for booking the first (or first 100) appointments in seasonal months

- Gift cards for appointment referrals

- Handwritten thank you note from the advisor they met

Online + Offline Marketing = More Quality Appointments

Promote your self-serve appointments across multiple channels, online and offline—like in your mobile app, in-branch displays, or through raffles. This two-pronged approach to marketing will increase your number of appointments, and increase the likelihood you’ll see the positive impact of appointments on your customer experience (and bottom line).