Katherine’s response to: “Go Beyond ROI With ‘Return on Experience’ in Banking”

I was nodding my head as I was reading Jim Marous’ recent article “Go Beyond ROI With ‘Return on Experience’ in Banking” as it’s been one of the most talked about topics when I speak to customers and the market in general.

Financial institutions must combine the return on investment calculations with the “return on experience” or ROX metrics in order to create the right conversations at the leadership level. And not limit it to the member or customer base experience, but extend to prospect, vendor and staff experience as well.

We all know that an exceptional experience improves brand affection, decreases churn and increases the chances of increasing share of wallet. But your staff can’t do it without the right processes, support and tools.

Jim is right on the money when he states “improving experiences by simplifying back-office processes and delivering intuitive solutions across all channels” – a paper and pen, or home-grown solution likely isn’t cutting it anymore for your members and customers. And it certainly takes away precious time from your staff. Having a well designed and well integrated tech stack means your team can reduce the manual, administrative tasks (often prone to human error) and instead can focus on the consultative, advice based conversations that tend to have the highest value.

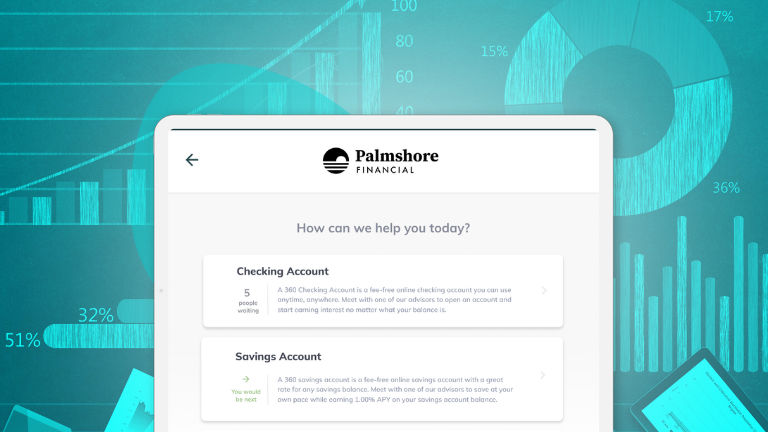

One of the most immediate benefits a solution like Coconut can offer, is the reduction in people-hours needed to do basic appointment scheduling and lobby management tasks. Something as simple as automating appointment reminders can save hours each week, and turns this mundane touchpoint into an opportunity to delight and connect with recipients.

In terms of the actual calculation of ROX, here’s where I think many financial institutions may have trouble. Net value of benefits is divided by the cost of the investment, then

multiplied by 100 to get the ROX. But what does “net value of benefits” mean and how do banks and credit unions actually track this? According to Jim’s article, and the quoted Salesforce report, it would include acquisition costs, time to market, speed to serve or customer effort score, customer satisfaction etc. But FIs must have the technology implemented to accurately track these inputs. Before considering how to calculate ROX consider:

- Can you accurately measure the number of appointments, no shows, or branch visits your institution has on a weekly basis?

- Do you have the ability to track the outcomes of those interactions?

- Can you track specific engagement points between your staff and your customers, and how satisfied both parties were with the interaction?

- Can you tie in your marketing efforts to services sold or appointments completed?

- Are you able to accurately predict traffic at your branches or the time it takes to complete specific services?

I totally agree with Jim’s position in this article, and can only imagine the introspective conversations required with your leadership team about what you can currently measure, in order to properly manage and track your ROX.