Bank Scheduling 101: The Ins and Outs to Better Financial Appointments

Pop quiz! Do you have an accurate pulse on your advisory staff’s activity right now? Are they over or under capacity? Do you know how full their appointment schedules are? Or how many appointments fall through the cracks? How long it takes your clients to find the person they’re looking for?

If you don’t have answers to these questions, you’re not alone. Despite the importance of facetime with customers and members, a surprising amount of financial institutions (FIs) don’t have readily available answers to the bank scheduling questions above. We’re here to change that, and help you learn the value of bank appointment scheduling.

Without a solid system in place, staff suffers by not being aware of capacity, managers are unable to evaluate and improve efficiency, and customers and members lose out on important information like availability and wait times.

Effective bank scheduling allows you to find out crucial information like how popular certain appointments are, how many advisors you need on-location, and how busy branches are during various times of the year.

In this primer, we walk through the ins and outs of assessing and improving your bank scheduling process to improve efficiency, create better customer experiences, and—ultimately—implement strategic decision-making at your financial institution.

What Is the Purpose of Appointment Scheduling?

Appointment scheduling is an essential tool for organizing touchpoints between customers, members, and staff at financial institutions. An appointment is often a requirement to complete different services and sell certain complex financial products.

Whether over the phone, via video, or in person, appointments greatly impact customer or member satisfaction, loyalty, and retention. Plus, these crucial client interactions provide your advisors with the best opportunities to upsell and cross-sell on key products and services—like mortgages, loans, and financial management.

Having an appointment scheduling process is meant to drive organization, efficiency, and an improved meeting experience for customers, members, staff, and management. Without a formal appointment scheduling process or system, keeping track of client interactions is nearly impossible, resulting in missed appointments and customer dissatisfaction. It also doesn’t allow staff (both frontline and advisory) or management to understand availability, upcoming commitments, or busy times at their branches.

For many FIs, the protocol for scheduling an appointment without a bank scheduling system goes something like this:

- Customer or member contacts the institution and waits for a response.

- Advisors manually check their calendars for availability.

- The appointment is set, with few (if any) reminders scheduled.

- Everyone crosses their fingers that the appointment isn’t a no-show or cancellation.

With digital appointment scheduling tools, institutions can track and streamline this process for both staff members (who need more functionality) and clients (who want more accessible options). For example:

- Customers and Members could visit your website, see open time slots based on specific search criteria, book a meeting for various lengths of time, and chat with specialists to go over questions or details.

- Staff and Advisors can see all booked meetings and open times, see the reason for appointments, receive automated messages when appointments are added to their schedules, keep appointment notes and follow-up tasks organized, and more.

- Branch, Operations, Retail, and/or Experience Managers and Leaders get a bird’s eye view of the number of appointments happening, where they happen (in-person or online), top reasons for appointments, satisfaction scores from customers, outcomes from those appointments (closed products or resolutions), staff availability and capacity, and more.

With a proper bank scheduling system, everyone gets the customization and convenience they’re craving. (That’s what we call a win-win situation. 🙌)

What Are the Appointment Scheduling Methods?

There are several different ways customers and members choose to make appointments with their financial institutions. Whether you’ve implemented bank appointment scheduling software already, or still use a combination of channels, the way someone chooses to book an appointment is still up to the individual customer or member or staff member they interact with.

Pre-book by Phone or Chat

It’s common for staff or advisors on-site to answer a call during business hours and help coordinate an appointment on behalf of a customer or member for a future date. They may do this by relaying this information to staff manually with a paper reminder, or by using an internal calendar tool. They may be able to do this instantly, but often have to wait to hear back from advisors about availability.

Bank scheduling software makes this interaction as easy as opening a back-end calendar view, and selecting the availability that makes the most sense for the client.

Walk-in and Speak to Teller

Walk-in clients are looking for facetime with knowledgeable and friendly staff members who can answer their questions right away. These customers and members are highly likely to want an appointment right then and there—so having an instant view of advisor availability is very beneficial for walk-ins.

With a bank scheduling system, walk-ins who need to wait a few minutes can also see wait times live on a TV screen (or tablet) in the lobby, and receive a text message or email as soon as their advisor is ready.

Contact Advisors Directly

If a customer or member has an existing relationship with an advisor, or has been referred to someone specific, they may also choose to book an appointment by emailing back and forth with an advisor directly. This can be an effective way to book appointments occasionally, but it can also lead to miscommunication with other staff members if the appointment isn’t then entered into a shared calendar.

Book Online With Bank Appointment Scheduling Software

For clients who prefer to do everything digitally, self-serve bank appointment scheduling software makes scheduling appointments easy, accessible, and instantaneous.

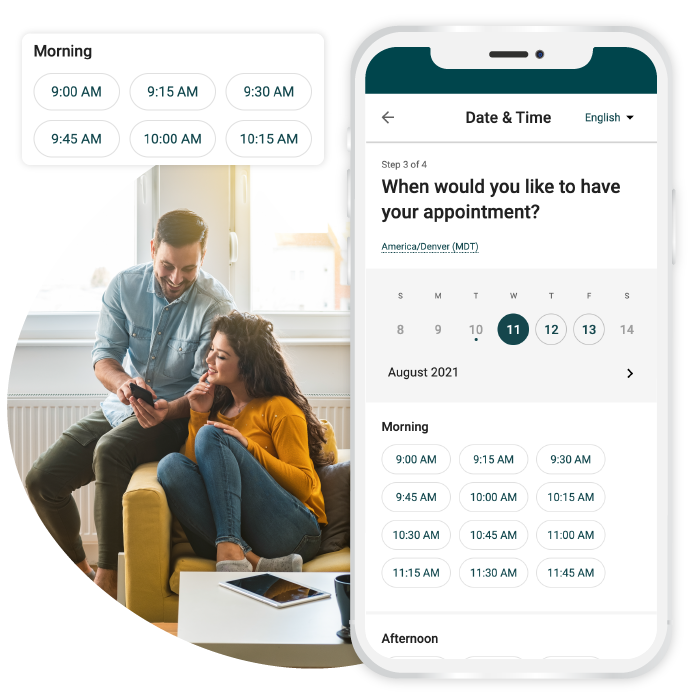

With dedicated scheduling resources, customers and members can book appointments in just a few steps by selecting which type of service they need, how they would like to meet (by phone, video, or in person), and the date and time that works best for them.

Why Use Bank Scheduling Software?

Here are a few more reasons why FIs should consider adopting more formal appointment scheduling processes with SaaS support.

- Reduce digital appointment booking abandonment

- Increase revenue

- Decrease client churn

- Gain data insights

- See higher close rates

- Optimize your advisors’ time

- Reduce no-shows and cancellations

- Improve NPS and CSAT scores

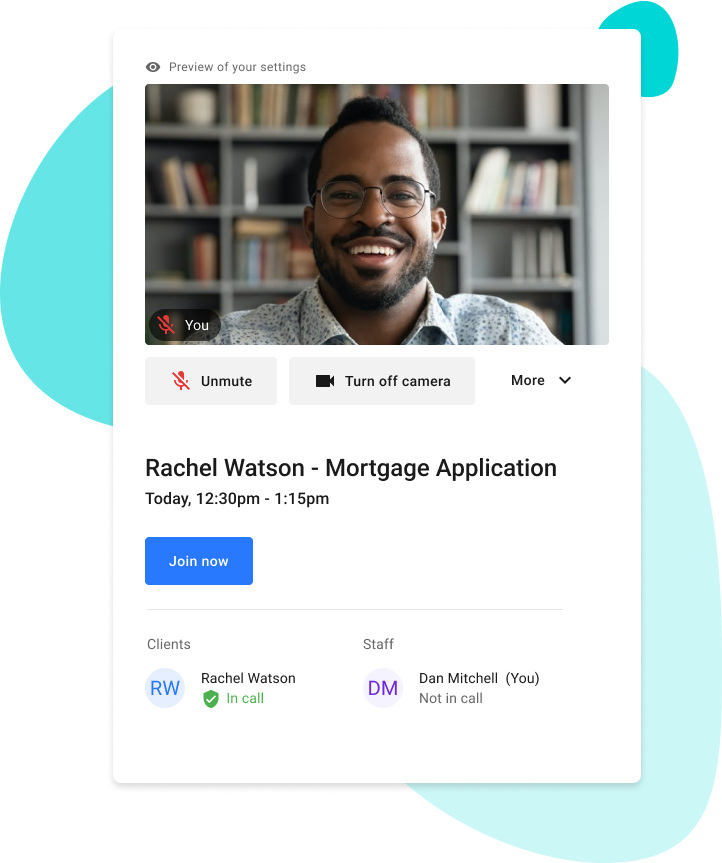

Remote Video or Virtual Call

Digital appointment scheduling also makes it much easier to book and attend virtual appointments. Video banking has gained immense traction over the last few years, and 36% of customers prefer video call appointments. Customers and members can choose between a hybrid meeting—where staff are located on-site, but the client is home, or a totally remote meeting—in which both parties are at home or elsewhere. Some institutions even provide a laptop for video calls when a client is on-site but needs to speak with a specialist who is either working from home or working at a branch in another location.

Why Online Scheduling is Beneficial vs. Manual Booking

Advisors who don’t use bank scheduling software (either by choice or because one hasn’t been implemented yet), usually have their own individualized methods for booking appointments. Some use physical paper calendars or place sticky notes around their office or in a day planner—which no one else has access to.

While these systems may work more or less for an individual advisor, they make it very difficult for staff, customers, members, and the institution at large to keep track of availability, engagements, and capacity.

With digital booking, multiple parties can see available time slots, book appointments, get reminders, share notes, and communicate—all before an appointment happens. This makes time tracking and appointment tracking so much easier for everyone involved, and results in fewer cancellations, and increased ROI.

What Are the Main Types of Scheduling Systems?

For institutions that have moved beyond the post-it note method and into the 21st century, there are a few main categories of digital/online appointment scheduling systems:

Calendar Tool

A lot of teams begin their online bank scheduling journey with a digital calendar tool (often connected to their email services like Microsoft Office or Gmail). These tools allow staff and advisors to track their individual meetings and book holds across calendars, but don’t have the same functionality as an organization-wide scheduling tool.

Appointment Scheduling Software

Bank appointment scheduling software is a tool that FIs can use internally to streamline the appointment-booking process. Team members can book appointments with advisors on behalf of a client faster, and with less back and forth. Plus, these software applications make it easy for staff to see availability, gain key data insights, and track what’s going on at an organization-wide level. They also have added features that make things like moving meetings and sending reminders easier than individual digital calendar tools.

Self-serve Appointment Scheduling Solutions

Some bank scheduling software include client-facing solutions as well as internal capabilities. These applications integrate white-label software into your financial institution’s website and app so that clients can choose what type of service they need, how they prefer to meet (over the phone, in person, video), and see a calendar with available appointment time slots.

Most other industries have self-serve solutions—why shouldn’t banks and credit unions strive for the same level of scheduling sophistication and accessibility?

The best self-serve bank scheduling software is accessible from any device and includes key appointment booking methods like the ones below:

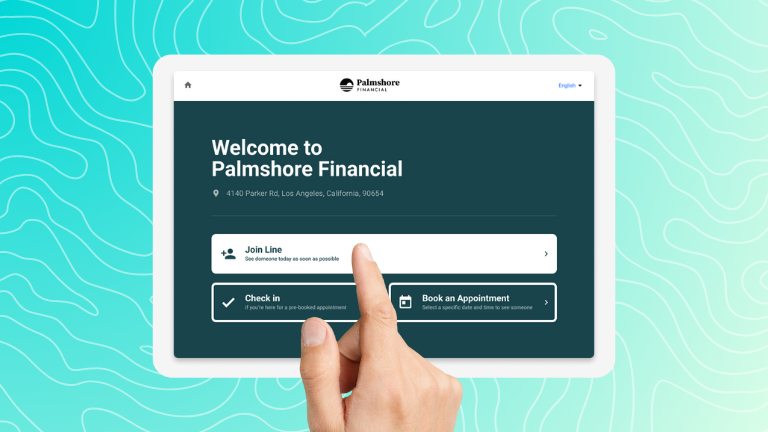

In-branch Kiosk (Screens That Allow for Booking)

Imagine your institution functioning like a posh salon where the customer can walk in, and schedule something immediately instead of waiting around aimlessly for a busy teller or staff member. Clients can use booking screens to feel confident they will be seen in a timely manner.

Book an Appointment’ Application on Your Website

Dedicate an entire page of your website to appointment scheduling so that customers and members know exactly where to look for any appointment they may need to book. This application lets customers and members see appointment types and select slots based on location, time, advisor, languages spoken, and more. The application can also re-route them to other self-serve channels if their needs are more transactional and don’t require an appointment.

Branch Locator Tool

Embed appointment bookings by location with a self-serve branch locator tool. Software with this functionality will display all of your branch locations on a single map, indicate which services are available at each location, provide estimated wait times, and allow customers or members to schedule appointments right then and there.

Your Institution’s Website

With the right tool, you can easily integrate appointment booking functionality into any page on your website, including contact us forms, informational pages about products or services, or individual advisor profiles. Clients can fill out their information, answer a few questions, and effectively schedule an appointment based on specific needs.

Chat or Chatbot Tool

With built-in chat functionality, scheduling an appointment can be instantaneous. Automated chat systems can send clients an appointment booking link, or if someone has more questions, an advisor can direct them through the chat as well.

Google Location Search Results Page

Did you know customers and members can book an appointment without ever switching to your institution’s website? Bank scheduling software embeds appointment booking capabilities directly into Google location search results. This way, a client can go from looking up the nearest branch to booking an appointment in just a couple of easy steps.

Mobile App and/or Online Banking Prompts

The goal of self-service is to reach the client at every touch point, so they have lots of options at their fingertips. Including prompts on your mobile app and online banking platform provides yet another opportunity for customers and members to book appointments easily.

Marketing Campaigns

Some self-service software solutions also include booking shortcuts that can be inserted into marketing campaigns and ads. These quick links lead customers or members directly to a booking page for a specific type of appointment like a loan application, rather than sending them to your website.

Individual Advisor Booking Links (Via Email or Text)

Advisors can also take advantage of booking shortcuts through email and text. When clients need a specific service, rather than directing them to a page with all available time slots, individual advisors can send a direct link that is synced to their calendars only.

What Are the Types of Scheduling Appointments?

Throughout different industries, there are several different methods for appointment scheduling. We’ll review just a few that banks and credit unions can benefit from. Some methods may work better for advisory appointments, while others may work better for handling day-of walkins or more transactional engagements.

Open Booking

This is the most flexible appointment strategy, because it gives clients a large window of time to come in, and allows room for walk-ins. With open booking, you might list availability in two-hour blocks like 1 pm–3 pm, and see people on a first-come-first-serve basis.

Open booking is great for low-priority appointments and slow days, but it can also lead to complications if an unexpected influx of clients arrives.

Time Slot

Time slot scheduling is the best option for high-priority advisory appointments like mortgages, loans, and wealth management. This system is straightforward and involves individual clients making appointments of varied lengths based on availability. With self-service in place, a customer or member can see several time slots available, select the one that works best for them, and receive automatic reminders about the appointment leading up to it.

Wave Scheduling

Wave scheduling is a popular appointment scheduling method (mainly in the medical field) that involves booking multiple people for the same time frame, and implementing a queue as they arrive. For example, a 9 am appointment will be listed as available until capacity for that wave is reached. Wave scheduling is best for institutions that have several advisor rooms available simultaneously so that clients aren’t left waiting very long.

Round Robin

Rather than FCFS (first-come-first-serve) or SJF (shortest-job-first) the round-robin approach assigns clients to advisors as they become available. For example, if five of your advisors are on-site for the day, rather than building a queue for each advisor, any one of them could receive the next customer or member. This creates a better average for wait times than FCFS or SJF alone.

What Are Examples of Appointments You Would Pre-Schedule via an Appointment System?

Rather than allocating staffing resources to every type of appointment, the main types of bank appointments you want your scheduling system to handle are those that are complex and often require individual assessment, guidance, and/or complex paperwork to complete.

xamples of appointments you would schedule

- Opening a new account

- New customer/member enrolment

- Mortgage advisement

- Loan or line of credit

- Financial health or wellness

- Wealth management

- Insurance

- General inquiry

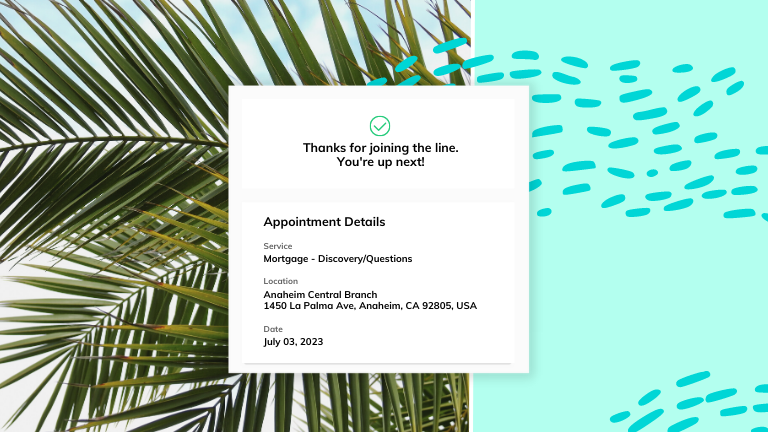

With bank scheduling software, clients fill out intake questionnaires when they book, allowing staff and advisors to review needs and requests in advance. Good appointment systems and processes will weed out transactional requests and redirect them to a teller or self-serve option so only quality appointments are booked.

Can You Host These Appointments Over Video or Virtually?

Appointment systems can also be beneficial for scheduling video (virtual) appointments. Good video or virtual banking solutions will allow you to complete a variety of transactions—including sharing documents live and capturing signatures—so there’s no need for separate email chains or for the client to come into a branch.

If your scheduling software includes video conferencing features, this can also be beneficial for things like financial education. However, regular conferencing tools cannot replace 1:1 video banking solutions. They often lack key features like signature collection, co-browsing, two-way chat, and other functionality that you might find in a video banking software.

The best video banking tools will also have security measures and identity verification tools that make holding video appointments safe, secure, and simple.

How Do You Schedule an Appointment With a Client?

For financial institutions, there are several steps to keep in mind when scheduling appointments on a daily basis.

- Determine client needs or requests clearly and record them in appointment booking notes.

- Understand time preferences or restraints. Are they far from a location but still need access ASAP? Would they prefer a digital appointment option?

- Review advisor availability based on client needs and preferences.

- Confirm dates and times that are available to the client.

- Have client confirm and book using their contact info (phone and/or email address).

- If your system doesn’t automatically send reminders, be sure to nudge clients about the appointment to reduce no shows a day in advance.

- Send them a reminder about any documents they may need to bring (ID, pay stubs, etc.) to complete a service

Today, a lot of appointment systems offer advisors a proactive, personal link they can provide via email or text that allows customers and members to reach out and choose a time slot on their individual calendars. Once clients select the link, the system will walk them through the steps above for self-service.

How Do You Schedule an Appointment Effectively?

Even if you’re familiar with all of the ways to schedule appointments, there are several factors that make appointment scheduling more efficient and effective.

Fast Routing

Ensure your client’s needs are clear, and that they’re sent to the right person right away. This includes digital routing—links to appointment scheduling are easy to find across digital properties (including your institution’s app), Google searches for your locations, location search pages on your website, and individual advisory pages.

Convenience and Flexibility

Give customers and members the convenience they crave! With lots of options for location, time, date, and channel at their fingertips, they can secure an appointment with ease. If you have a digital system in place, self-serve capabilities will elevate the client experience and allow them to easily make changes and see updates in real time.

Prep Work and Reminders

Be sure to get clarifying details and requests from clients—whether you’re scheduling their appointment manually or via self-serve booking options. It’s also crucial to remind clients which items to bring to their appointment (like photo ID, proof of residency, etc.).

Give Clear Expectations

Let clients know what to expect during their appointment and afterward. For example, you might inform a customer/member that during their 30-minute appointment, you will go over their application, either approve or give instructions on next steps, and that you’ll be sending a follow-up email the following day. The more people know about their appointment beforehand, the more confident they’ll feel in following through.

What Do You Say When Scheduling an Appointment?

When it comes to appointment scheduling, it’s best not to leave anything up to interpretation. The best bank scheduling software will incorporate these details into appointment booking.

- Be clear about when and where the appointment is happening

- Introduce who they’ll be talking to

- Make it clear what to expect of the appointment

- List what they should bring (ID, pay stubs, etc.)

- Ask if they have questions

- Let them know the process for changing their appointment (lots of self-serve systems let them do this themselves)

Now that you know the ins and outs of stellar bank scheduling, it’s time to assess tools, and determine the best Bank Appointment Scheduling Software for your institution.