Balancing Millennials and Boomers in a Self-Service Era

When banks and credit unions discuss the industry’s current digital transformation and its push toward a more comprehensive mobile and online experience, it’s easy to get stuck thinking about it as a service that solely caters to the Millennial mindset. As discussed on our previous post on attracting Millennial clients, the ability to view real-time account balances, pay bills instantly, transfer funds around the world and more, speaks directly to their desire for ‘instant gratification.’

But what about your non-millennial clients? While it’s no secret that digital offerings provide an enhanced banking experience, it can be hard to imagine that existing Baby-boomers and seniors are reaping any benefits from these services. However, although older clients may not be digital natives, they are getting online more and more and are beginning to share more in common with their younger counterparts than many realize.

Ready to discover what processes in your contact center are damaging your customer effort score? Schedule a customer effort assessment.

Top 3 Myths about Differences Between Millennials and Baby-Boomers

1. Baby-boomers prefer to do their banking in branch. Digital transformation is an investment aimed solely toward our younger clients.

Millennials aren’t the only generation that appreciates advanced technology. In fact, Baby-boomers represent the fastest growing segment of technology consumers, spending more money on tech than any other generation. More active than their parents’ generation, technology has given Boomers the support they need for their on-the-go lifestyles. In the past three years, their use of mobile has rocketed with social networking up 1,113%, product information searches up 567% and listening to music, up 266%. And this holds true when it comes to their financial needs as well, with online banking rated the first choice for more than half of all clients over 65. Their growing comfort with technology is an open invitation for banks and credit unions. They may be older, but they aren’t old, and they expect the companies they do business with to keep up with the times.

Takeaway:

Creating a seamless online and mobile experience for everyday financial needs should be a priority for your bank or credit union as you engage with your older clients.

2. Millennials prefer all digital, all the time. There’s no need to change the way things are done in branches.

While Millennials have eagerly embraced technology, they are far from abandoning brick and mortar banks. When it comes to rating what they look for when selecting a banking institution, it might be surprising to learn that research from the Bank Administration Institute (BAI) shows that Millennials actually rate convenient branches as their number one priority — even higher than Baby-boomers. These days, younger clients have come to assume that a bank will offer streamlined digital access to their accounts. But they also assume that as new channels evolve, the old ones will remain available while evolving alongside. And they use all channels. In fact, BAI’s research shows that Millennials use every one of their primary financial institution’s services — from physical to digital — more in a month than any other generation. They’ve simply grown up with information and services readily available at all times, and that carries over to their approach to finance. At the same time, they expect the experience across all these channels to be just as seamless.

Takeaway:

The in-branch experience needs to be updated alongside digital services to ensure that clients can go from online to offline with ease.

3. Our existing clients are loyal boomers. They will sustain business while we slowly roll out digital options for younger clients.

While loyalty is indeed higher among Boomers than Millennials, with the older population embracing technology more and more they aren’t above switching banks to take advantage of better options. According to a report from Novantas, 1 in 5 clients who recently switched banks were Boomers, with the main reason for switching being greater convenience and better service. In fact, one third of the Baby-boomers surveyed were open to ditching traditional banks altogether and moving to a purely digital branch like Amazon in the future.

Takeaway:

Adapting to match the convenience that new providers are offering clients is just as important in retaining existing clients as it is in attracting new ones.

How can Coconut Software Help Bridge the Gap?

When BAI asked survey participants from all generations what their main banking provider could do to improve their experience, they ranked their responses as:

- Better omnichannel experience so I don’t always have to start over between channels

- Transform the branches — e.g., experts to help me with my financial goals

- Enhance the mobile channel (like Amazon)

So it’s clear that whether you’re looking to target Millennials or Baby-boomers, your clients’ expectations are the same. The more convenience you can offer them, the better. These shifting demands can be difficult to address, but there are ways to satisfy all of your clients by leveraging new technologies to implement solutions and attract the growing population of Millennials, while meeting the changing desires of your existing Baby-boomer clients.

Improve the Omnichannel Experience

When dealing with Millennials, it’s important to remember that they’ve grown up expecting to be able to access the information they want, when they want — and they are quick to abandon the process when things don’t go smoothly. At the same time, Baby-boomers are becoming increasingly confident with technology and the new levels of convenience it offers, but they seek clear direction, and any extra steps in the process can easily lead to frustration. Through Coconut Software’s custom tailored solutions, you can create a unique customer journey across all channels, and for all client types. Whether they prefer to reach out through the contact center, your mobile app, on your website or directly with a staff member, all data is captured and centralized in order to create consistency and ensures that clients aren’t required to start over at every touchpoint.

Learn more about Coconut Software’s omnichannel experience solutions.

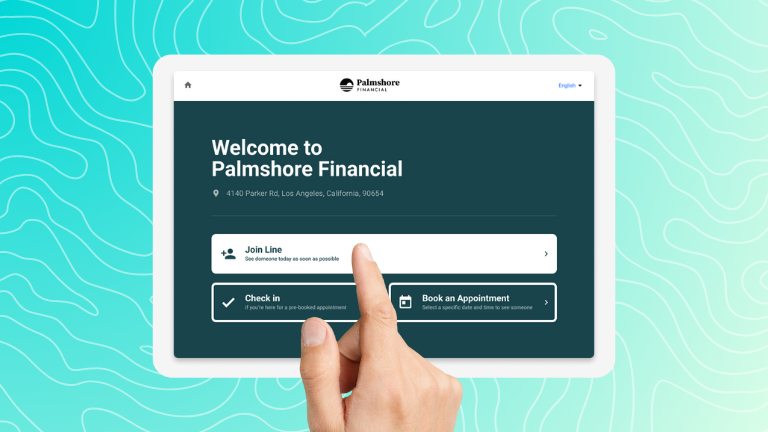

Implement a Lobby Management Solution

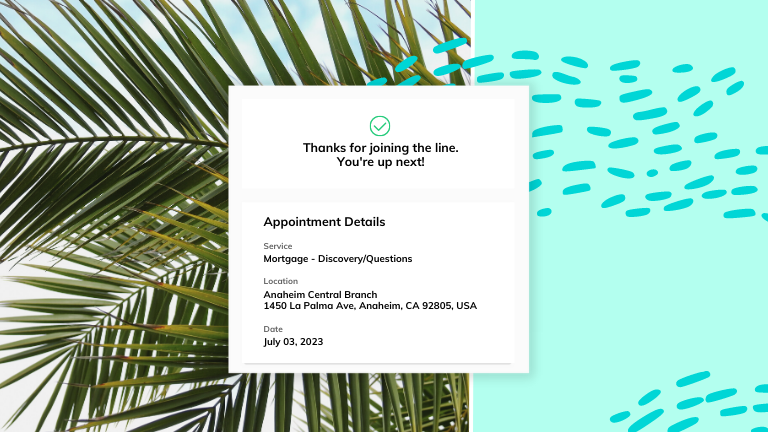

With more Millennial and Baby-boomer clients beginning their purchase journey online, it’s vital to ensure that you have tools in place to keep the experience moving smoothly during occasions when an in-branch meeting is required. Likewise, you want to ensure that walk-in traffic is welcomed and acknowledged. By taking advantage of a lobby management solution, you can streamline the experience from start to finish. With the ability to provide both walk-in and appointment driven traffic with an in-branch self-service solution that gives a clear expectation of when a representative will be able to see them and how long it will take, as well as giving them the option to schedule a meeting at a later date on that same system, you provide them with more freedom and let them know that their business is appreciated. At the same time, management is able to track and measure operations metrics across branch locations, allowing them to make more informed decisions and improve the experience even further.

Streamline your Self-Service Options

Time and convenience are highly valued by clients. A study by Forrester found that 72% of clients prefer to use self-service rather than phone or email support, and those numbers include Baby-boomers as well. The internet and mobile phones have changed the way both the Millennials who were born to them and the older generations who have adapted to them behave. Consumers demand instant customer service and become highly annoyed when they have to wait. By implementing an easy to use online self-service booking channel and accepting appointments around the clock, you are able to capture business that might otherwise be missed entirely. With all staff schedules, locations, and services streamlined on one central platform, self-service clients are provided with more options, filtered to accommodate to their needs.

Discover more reasons to consider self-service solutions.

A Better Experience For Everyone

When clients start out their interaction with your organization through an effortlessly streamlined process, you are setting your organization up for success. With Coconut Software’s tailored solutions, there are multiple benefits that can both increase customer acquisition and improve branch performance while enhancing the customer journey for both Baby-boomers and Millennials alike.

Millennials and Boomers in a Self-Service Era – What’s next?

Ready to discover what processes in your contact center are damaging your customer effort score? Schedule a customer effort assessment.

Interested in learning how appointment scheduling can help your entire organization engage more efficiently and effectively with clients? Download our Customer Experience Whitepaper.

Ready to get started? Schedule a consultation today.